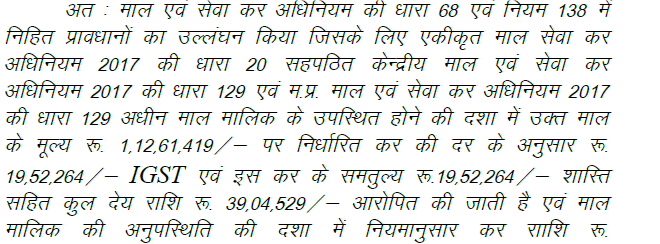

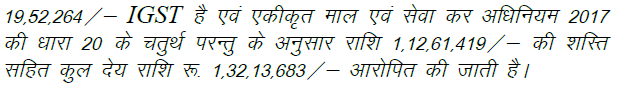

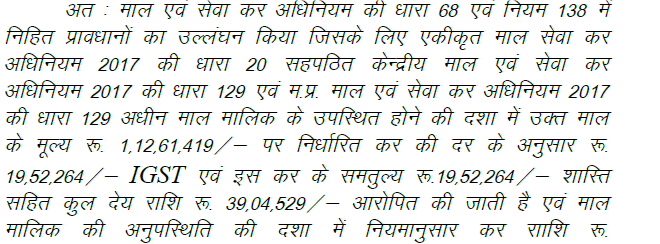

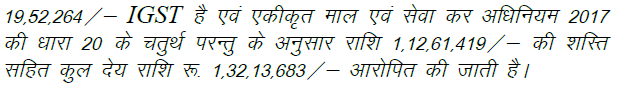

ORDER By this writ petition under Article 226 of the Constitution of India, the petitioner is praying for quashment of order dated 30.05.2018 passed by the respondent No.2 – GST Appellate Authority & Joint Commissioner of State Tax, Indore and order dated 04.05.2018 passed by the respondent No.3 – Assistant Commissioner of State Tax, Indore wherein demand and penalty imposed by the respondent No.3 has been upheld and directed the petitioner to pay the amount of ₹ 1,32,13,683/-. Relevant part of the order dated 04.05.2018 passed by the respondent No.3 reads as under :-

2. This order has been challenged by filing an appeal before the respondent No.2. The respondent No.2 vide impugned order dated 30.05.2018 came to the conclusion that the petitioner has violated the provisions of Section 68 r/w Rule 138 of the Central Goods and Service Tax Act, 2017 and M. P. Goods and Service Tax Act, 2017 and dismissed the appeal.

3. Facts of the case are that the petitioner is a Private Limited company engaged in the business of multi model transportation of shipments, supply chain management and other allied services such as door to door pick-up and delivery of the shipments etc.

4. On 01.07.2017, M. P. Goods and Service Tax Act, 2017 came into force and was published in the M. P. Gazette on the same day to make provisions for levy and collection of tax on Inter and Intra State Supply of Goods or Services or both by the State of M. P. and the matters connected therewith and or incidental thereto.

5. Section 68 of the Act provides for inspection of goods in movement, which reads as under :-

1. The Government may require the person in charge of a conveyance carrying any consignment of goods of value exceeding such amount as may be specified to carry with him such documents and such devices as may be prescribed.

2. The details of documents required to be carried under sub-section (1) shall be validated in such manner as may be prescribed.

3. Where any conveyance referred to in sub-section (1) is intercepted by the proper officer at any place, he may require the person to charge of the said conveyance to produce the documents prescribed under the said sub-section and devices for verification, and the said person shall be liable to produce the documents and devices and also allow the inspection of goods. From perusal of the aforesaid provision, it is clear that the government is empowered in charge of a conveyance carrying any consignment of goods of value exceeding such amount as may be specified to carry with him such documents and such devices as may be prescribed.

6. In the light of the power conferred under Section 68, the vehicle of the petitioner company was checked on 27.04.2018. On enquiry, the driver (person incharge of a conveyance) of the vehicle bearing registration No.HR-47-C-2647 produced the bill and challan, but eway bill on enquiry, it was found that the petitioner transporter company who was transporting the goods from Pune(Wadki), Maharashtra to Noida via Indore and other different places has not uploaded/updated the part-B of the e-way bill which is a required condition to be fulfilled in accordance with Rule 138(5) of the M. P. Goods and Service Tax Rules, 2017. Rule 138(5) of the Rules of 2017 reads as under :-

138(5) Where the goods are transferred from one conveyance to another, the consignor or the recipient, who has provided information in Part A of the Form GST EWB-01, or the transporter shall, before such transfer and further movement of goods, update the details of conveyance in the e-way bill on the common portal in Part B of Form GST EWB-01.

7. Annexure-P/6 is the e-way bill. The details as mentioned in paras-2, 3, 4 & 5 are relevant, which reads as under :-

2. Address Details

| From | To |

| GSTIN : 27AAE DA945 6D1ZM SAVA HEATHCARE LIMITED CFA MIRCOPARK LOGISTICS1ST FLOOR GATE NO.1232 WADKI, MAHARASHTRA-412308 | GSTIN :D9CFE PS825 3Q12F M/S ANNAPURNA PHARMA DAYA COMPLEX OPP. SHRI TALKIES BYPASS ROAD UTTAR PRADESH -282003 |

3. Goods Details

| HSN Code | Product Description | Quantity | Taxable Amount Rs. | Tax Rate (C+S+I+Cess) |

| 30049086 | | 10976.00 | 2226598. | 00 0+0+12+0 |

Net Taxable Amount : 2226598.00

CGST Amount ₹ 0.00 SGST Amount ₹ 0.00

IGST Amount ₹ 267191.52 Cess Amount ₹ 0.00

4. Transportation Details

36AADCG2096A1ZY & GATI-KINTETSU EXPRESS PRIVATE

Transporter ID & Name : LIMITED

Transporter Doc. No. & Date : 229076616 & 25/04/2018

5. Vehicle Details

| Mode | Vehicle/Trans Doc No. & Dt. | From | Entered Date | Entered By | CEWB No. (if any) |

| Road | MH14EM1313 | Pune | 25/04/2018 07.49 PM | 36AADCG2 096A12Y | 1410467481 |

| Road | MH14EM1313 | Bhursungi | 25/04/2018 07.43 PM | 36AADCG2 096A12Y | |

| Road | MH04CG8538 & 229076818 & 25/04/2018 | Wadki | 25/04/2018 03.26 PM | 27AAECA9 456D1ZM | |

8. In the light of Section 164 of the M. P. Goods and Service Tax Act, the State Government has framed the M. P. Goods and Service Tax Rules, 2017 which were further amended vide notification dated 07.03.2017 and the amendment came into force w.e.f. 01.04.2018 which substituted the earlier Rules of 138 by the new Rules.

9. As per Rule 138 of the Rules of 2017, any registered person who causes movement of goods or assignment valuation exceeding ₹ 50,000/- must upload the information in a shape of e-way bill containing Part-A and Part-B. Sub-caluse 5 of Rule 138 provides for updating the Part-B which contains the detials about the vehilce and transporter.

10. In the case in hand, admittedly, the petitioner has failed to give the details in Part-B of the e-way bill i.e., the details of conveyance in the e-way bill and the common portal in Part-B of Form GST EWB-01. The petitioner violated the provisions of Rule 138 and Section 68 of the Act, therefore, proceeding was initiated under Section 129 of the Act and penalty was imposed under Section 122 of the Act since he was transporting the taxable goods without the cover of documents.

11. The Department, after following due procedure, issued show cause notice and penalty case was registered. The petitioner submitted its reply by stating that due to technical error, Part-B of the e-way bill cannot be updated.

12. Learned adjudicating Authority considering the fact that the petitioner has failed in performing the statutory provisions, penalty was imposed, which was assailed by filing an appeal and the same was also dismissed by the respondent No.2.

13. The stand of the respondents is that the petitioner company is a leading transportation company and the explanation submitted by him that due to technical error, Part-B of the e-way bill cannot be updated has not been accepted by the authority because the portal of the goods or service tax provides for an option of grievance in case the petitioner was having any problem in updating the Part-B of the e-way bill. No such grievance has been raised by the petitioner and he has never given any written grievance so that the grievance with regard to the updating the technical error could not have been considered.

14. It is also stated by the learned authority that the petitioner is a National Level Courier company and engages the employees who are expert in uploading e-way bills. As per the Rules, it is a mandatory requirement that Part-B must be updated in the e-way bill and in case the Part-B is not updated, the e-way bill is not genuine/legal and therefore, it is not a minor mistake or cannot be treated as a technical error when there is an option of raising a grievance on the GST portal itself.

15. The Assessing Officer as well as the learned Authority rejected the contention that they should have imposed minor penalty. Their stand is that the minor penalty can only be in cases where the tax is upto ₹ 5,000/-.

16. In the present case, tax liability is more than lac of rupees and, therefore, they have refused to impose minor penalty and prayed for dismissal of the writ petition.

17. From the aforesaid facts of events, it is clear that while loading the goods valued at ₹ 1,12,61,419/- (including transportation charges), during Inter and Intra State of Supply of Goods or Services from Wadki, Maharashtra to Noida were accompanied by e-way bill The respondent No.2 has directed for physical verification. On physical verification, respondent No.3 has found the alleged irregularity that Part-B of the e-way bill was incomplete and, therefore, he has detained the vehicle as well as the goods by passing an order under Section 129 (1) of the Act. by which he assessed the value of the goods.

18. Consequently, a notice under Section 129(3) of the Act has been issued by which he has directed the petitioner to pay the same towards the tax liability as well as the same amount towards penalty.

19. On 04.05.2018, an order was passed and being aggrieved by the aforesaid order, he filed an appeal, which was also dismissed and, thereafter, instant writ petition has been filed.

20. The contention of the petitioner before the learned Authority was that there was no intention on the part of the petitioner to evade payment of tax during Inter and Intra State Supply of Goods or Services. The goods loaded in the vehicle was for the purpose of transportation of goods from Wadki, Maharashtra to Noida and as such, the petitioner at the time of generation of national e-way bill could not fill the vehicle number in the Part-B due to inadvertence and it was a technical error therefore, the objection with regard to non-filling of the Part-B of e-way bill is nothing but a clear abuse of process of law.

21. Learned counsel for the petitioner has placed reliance on the Division Bench decision of Allahabad High Court in the case of VSL Alloys (India) Pvt. Ltd. vs. State of UP & others reported in (2018) 67 NTN DX 1 and submitted that in identical circumstances, the Division Bench found that there was no ill intention at the hands of the petitioner nor the petitioner was supposed to fill up Part-B giving all the details including the vehicle number before the goods are loaded in the vehicle, which is meant for transportation to the same to its end destination.

22. In the case of VSL Alloys (India) Pvt. Ltd. (supra), the distance was within 50 kilometeres and, therefore, the petitioner therein was not under an obligation to fill the Part-B of the e-way bill and the Division Bench of the Allahabad High Court has rightly quashed the order.

23. In the present case, the distance was more than 1200-1300 kilometers and it is mandatory for the petitioner to file the Part-B of the e-way bill giving all the details including the vehicle number before the goods are loaded in the vehicle. Thus, he admittedly violated the provisions of the Rules and Act of 2017 and, learned Authority rightly imposed the penalty and directed the petitioner to pay the same. The order is not in violation of any of the provisions of the Rules and Act of 2017. The writ petition filed by the petitioner has no merit and is accordingly, dismissed.

Prices of BUSY Increasing from 1st June, 2024. Click Here

Prices of BUSY Increasing from 1st June, 2024. Click Here