ORDER The present application has been filed Under Section 97 of the Central Goods and Services Tax Act, 2017 and the Maharashtra Goods and Services Tax Act, 2017 [hereinafter referred to as “the CGST Act and MGST Act” respectively] by M/s. KAPIL SONS, the applicant, seeking an advance ruling in respect of the following question.

1. Whether the activity to be carried by the applicant shall be classified as supply of goods or services or a composite supply of ‘works’ contract’?

2. Whether the activity should be classified as Composite Supply of works contract for Construction of tunnel under Entry 3 (iv) of Notification No. 11/2017-CT (Rate) dated 28.06.2017 taxable at the rate of 12%?

At the outset, we would like to make it clear that the provisions of both the CGST Act and the MGST Act are the same except for certain provisions. Therefore, unless a mention is specifically made to any dissimilar provisions, a reference to the CGST Act would also mean a reference to the same provision under the MGST Act. Further to the earlier, henceforth for the purposes of this Advance Ruling, the expression ‘GST Act’ would mean CGST Act and MGST Act.

2. FACTS AND CONTENTION – AS PER THE APPLICANT

The submissions made by M/s Kapil Sons are as under:-

2.1 M/s. Kapil Sons, the applicant is registered under GST and engaged in drilling and blasting works at various sites using Industrial explosives and other materials.

2.2 Government of Maharashtra entrusted Maharashtra State Road Development Corporation Limited (MSRDC), a corporation fully owned by Government of Maharashtra, the development, operation and maintenance of Two Tunnel (Two Tubes of four lane each) for Missing Link under Capacity Augmentation of Mumbai Pune Expressway in Mumbai.

2.3 MSRDC resolved to construct the same, invited proposals for short listing of bidders for EPC and accepted the bid of a company M/s Navyauga Engineering Company Limited (Main Contractor) and issued its Letter of Acceptance. MSRDC entered into an Engineering, Procurement and Construction Agreement on 11th of October 2018 with M/s Navyauga Engineering Company Limited for the following work:

Construction of Two Tunnel (Two tubes of four lane each) for Missing Link under Capacity Augmentation of Mumbai Pune Expressway in the state of Maharashtra under EPC mode.

2.4 In relation to the work awarded under above EPC Agreement, the main contractor engaged the applicant for a sub-contracting arrangement for the construction of tunnel by drilling and blasting method and issued a work order for subject work titled as under:

Work Order for Drilling & Blasting Charges for Missing Link Project, Maharashtra – reg.

The description of supply to be made by the applicant was “Drilling and Blasting including all tools, materials, explosive vans etc complete for approach roads and tunnel works.

B. STATEMENT CONTAINING APPLICANT’S INTERPRETATION OF LAW AND/OR FACTS Legal Provisions as applicable

2.5 The charging section for GST is Section 9 of the Central Goods and Services Tax Act 2017. The term “goods” has been defined under section 2(52) of the CGST Act, 2017. The term “services” has been defined under section 2(102) of the CGST Act, 2017. Section 2(30) defines a composite supply and the term works contract has been defined under Section 2(119) of the CGST Act, 2017. Further, clause 6 of the Schedule states that works contract as defined in clause (119) of section 2 shall be treated as a supply of services.

2.6 The GST rates on services have been notified by the Government in Notification No. 11/2017-Central Tax (Rate) dated 28.06.2017 which has been amended by various notifications and Sr.No 3 (iv) of the said notification (as amended up to date) states that Composite supply of works contract as defined in clause (119) of section 2 of the Central Goods and Services Tax Act, 2017, [other than that covered by items (i), (ia), (ib), (ic), (id), (ie) and (if) supplied by way of construction, erection, commissioning, installation, completion, fitting out, repair, maintenance, renovation, or alteration of a road, bridge, tunnel, or terminal for road transportation for use by general public attract 12% GST.

Interpretation of provisions and applicable concepts

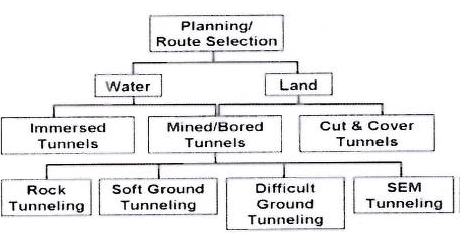

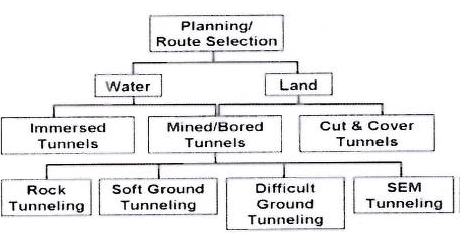

2.7 The nature of work awarded by MSRDC needs to be understood. Construction of tunnel involves a series of steps including planning for various factors including, route studies, Tunnel type studies, geotechnical investigation, operational and financial planning, risk management etc.

2.8 There are various methods of construction of tunnel also known as tunneling methods, as depicted in above chart and the main contractor has to undertake rock tunneling for the awarded work. The rock tunneling methods generally prevalent in use are:

- Drill and Blast

- Tunnel Boring Machines (TBM)

- Road headers

- Other Mechanized Excavation Method

- Sequential Excavation Method (SEM)/New Austrian Tunneling Method (NATM)

2.9 The main contract has engaged applicant for the construction of tunnel by drill and blast technique of tunneling. The issue for consideration is with respect to classification of the said supply. The cycle of drilling and blasting activity to be undertaken by the applicant involves the following steps:

• Drilling blast holes and loading them with explosives.

• Detonating the blast, followed by ventilation to remove blast fumes.

• Removal of the blasted rock (mucking).

• Scaling crown and walls to remove loosened pieces of rock.

• Installing initial ground support.

• Advancing rail, ventilation, and utilities.

2.10 It is seen that various goods including explosives, tools and other material have to be used during the process of blasting and hence there is an element of goods involved in the transaction. Further, undoubtedly there is a service element in carrying out the whole process starting from drilling till the end by removing the rubble. Hence the activity involves both goods and services.

2.11 The elements of the definition of Works Contract under Section 2(119) of the Act are as under:

- a contract for building, construction, fabrication, completion, erection, installation, fitting out, improvement, modification, repair, maintenance, renovation, alteration or commissioning

- of any immovable property

- wherein transfer of property in goods (whether as goods or in some other form) is involved in the execution of such contract;

2.12 That in respect of above conditions, the applicability of facts of case are as under:

- It is seen from the work order that, the applicant is engaged for construction of tunnel by drilling a blasting technique for construction of approach roads and Tunnel works. Hence it is a contract for construction.

- The Tunnel and road is undoubtedly immovable property.

- Now, it needs to be interpreted whether there is transfer of property in goods (whether as goods or in some other form) involved in execution of contract, based on provisions of law and legal jurisprudence available in this regard.

2.13 Goods are defined in the CGST Act as every kind of movable property. The materials used for drilling and blasting are movable property in their own identity before incorporation in execution of the project. Now for the question whether there is transfer of property in goods involved in execution of project, a very important point of consideration is that instead of only using the word goods, the statute has used an expression being goods (whether as goods or in some other form) in the definition of works contract.

2.14 It is relevant to the subject issue that an exhaustive debate has taken place/dealt with, by a three judge bench of Supreme Court in Larsen and Toubro Limited and another vs. State of Karnataka and another (2014) 1 SCC 708 = 2013-TIOL-46-SC-CT-LB. The provisions of clause (29A)(b) of Article 366 of the Constitution of India has been considered in Larsen & Toubro Limited (supra) and it has been held that the expression “goods (whether as goods or in some other form)” appearing in sub-clause (b) of clause (29A) of Article 366 of the Constitution of India has the effect of enlarging the term “goods” by bringing within its fold goods in all different forms.

Paragraph 56 of the opinion rendered in Larsen & Toubro Limited (supra) reads as under:

“56. It is important to ascertain the meaning of sub- clause (b) of clause (29-A) of Article 366 of the Constitution. As the very title of Article 366 shows, it is the definition clause. It starts by saying that in the Constitution unless the context otherwise requires the expressions defined in that article shall have the meanings respectively assigned to them in the article. The definition of expression “tax an sale or purchase of the goods” is contained in clause (29-A). If the first part of clause (29-A) is read with sub-clause (b) along with latter part of this clause, it reads like this: “tax on the sale or purchaser of the goods” includes a tax on the transfer of property in goods (whether as goods or in some other form) involved in the execution of a works contract and such transfer, delivery or supply of any goods shall be deemed to be a sale of those goods by the person making the transfer, delivery or supply and a purchase of those goods by the person to whom such transfer, delivery or supply is made. The definition of “goods” in clause (12) is inclusive. It includes all materials, commodities and articles. The expression, “goods” has a border meaning than merchandise. Chattels or movables are goods within the meaning of clause (12) Sub-clause (b) refers to transfer of property in goods (whether as goods or in some other form) involved in the execution of a works contract. The expression “in some other form” in the bracket is of utmost significance as by this expression the ordinary understanding of the term “goods” has been enlarged by bringing within its fold goods in a form other than goods. Goods in some other form would thus mean goods which have ceased to be chattels or movables or merchandise and become attached or embedded to earth. In other words, goods which have by incorporation become part of immovable property are deemed as goods. The definition of “tax on the sale or purchase of goods” includes a tax on the transfer or property in the goods as goods or which have lost its form as goods and have acquired some other form involved in the execution of a works contract.”

2.15 The Larger Bench of the Apex Court summarized law and facts as

(i) For sustaining the levy of tax on the goods deemed to have been sold in execution of a works contract, three conditions must be fulfilled: (one) there must be a works contract, (two) the goods should have been involved in the execution of a works contract and (three) the property in those goods must be transferred to a third party either as goods or in some other form.

(ii) For the purposes of Article 366(29-A)(b), in a building contract or any contract to do construction, if the developer has received or is entitled to receive valuable consideration, the above three things are fully met. It is so because in the performance of a contract for construction of building, the goods (chattels) like cement, concrete, steel, bricks etc. are intended to be incorporated in the structure and even though they lost their identity as goods but this factor does not prevent them from being goods.

Hence the Apex Court of law has held that transfer of property in such goods takes place when the goods are incorporated in the works and even though if they loose their identity as goods, this factor does not prevent them from being goods. Hence there is a transfer of property in goods, in some other form involved in the execution of construction project.

2.16 Further, in this regard, the judgment of Hon’ble Supreme Court in the case of State of Gujarat Vs. Bharat Pest Control (Civil Appeal No. 1335 of 2018] = 2018-170L-310-SC-VAT is relevant, wherein it has been held as follows :-

“5. A Constitution Bench of this Court in Kane Elevator Indio Private Limited vs. State of Tamil Nadu, while considering the correctness of its earlier view with regard to dominant nature of the contract test, has apart from holding that the dominant nature test would no longer be determinative, considered paragraph 56 of the report in Larsen & Toubro Limited 2 (2014) 7 5CC 1 (supra) and has accepted the same to be the correct position in low.

6. In view of the above position of law enunciated in Larsen & Toubro Limited (supra) and Kone Elevator India Private Limited (supra) the view taken by the High Court that there is no deemed sale of the goods used in the contract executed by the respondent – contractor cannot have our approval. We, therefore, set aside the order of the High Court and allow this appeal.”

Hence on the basis of above interpretation, applicant is of a view that all the conditions of works contract under Section 2(119) are met for the work of tunnel construction by drilling and blasting techniques given to applicant.

That under Schedule II of the Act, Entry 6 specifies that composite supply of works contract as defined under Section 2(119) of the Act is a supply of service.

2.17 Further the Advance Ruling Authority of Gujarat in case of M/s KHEDUT HAT [2018-TIOL-173-AAR-GST] has held that blasting work with use of explosives is a composite supply. The ruling pronounced is as under:

There is deemed supply of explosives in this case in view of the judgement of Hon’ble Supreme Court in the case of Bharat Pest Control – 2018-170L-310-SC-VAT as well as the supply of service in the form of the blasting work – Therefore, the situation as narrated by the applicant is a ‘composite supply’ of goods and services and shall be covered by Section 2(30) and Section 8(a) of the CGST Act, 2017 and the GGST Act, 2017: AAR

Based on interpretation of above relevant facts and material, the classification entry in SI. No. 3(iv) of Notification No. 11/2017 – CT(Rate) appears to be the correct classification of the activity undertaken by the applicant. That the supplies classifiable under the above entry are taxable at the rate of 12% and hence the applicant is of the view that the activity carried out by applicant shall be taxable under the above classification under HSN 9954 and be taxable at the rate of 12%.

03. CONTENTION -AS PER THE CONCERNED OFFICER:

OFFICER SUBMISSION DATED 18.11.2021:-

The applicant has declared the description of goods and services in their registration as under:

| Goods | Service |

| HSN | Description | HSN | Description |

| 36020010 | PREPARED EXPLOSIVES, OTHER THAN PROPELLANT POWDERS PREPARED EXPLOSIVES, OTHER THAN PROPELLANT POWDERS: INDUSTRIAL EXPLOSIVES | | |

| 36030011 | SAFETY FUSES; DETONATING FUSES; PERCUSSION OR DETONATING CAPS; IGNITERS; ELECTRIC DETONATORS SAFETY FUSES; DETONATING FUSES; PERCUSSION OR DETONATING CAPS; IGNITERS; ELECTRIC DETONATORS: SAFETY FUSES: FOR MINE BLASTING | | |

On going through the above process, it is clear that various goods including explosives, tools and other material have to be used during the process of blasting and hence there is an element of goods involved in the transaction. Further, undoubtedly there is a service element in carrying out the whole process starting from drilling till the by removing the rubble. Hence the activity involves both goods and services.

It appears that the applicant is a sub-contractor and providing services to M/s Navayuga Engineering Company Ltd. (Main Contractor). M/s Navayuga Engineering Company Ltd. have signed an agreement with MSRDC a corporation which is fully owned by Govt. of Maharashtra.

Further, as per work order, it appears that, activities carried out by the applicant may be classified as composite supply of works contract for construction of tunnel under Entry 3(iv) of Notification No. 11/2017-CT (Rate) dated 28.06.2017 with taxable rate of GST 12%. However, the applicant has declared only goods having HSN 36020010 & 36030011 in their GST registration and they have never mentioned about any services in their GST registration at the time of execution of the works order i.e. Nov, 2018.

04. HEARING

4.1 Preliminary e-hearing in the matter was held on 30.11.2021. The Authorized representative of the applicant, Shri. Yash Ladda, learned CA and Smt. Shuchi Sethi, learned CA were present. The Jurisdictional officer Smt. Suvarna Athanikar, learned Superintendent, Div II Swargate was present.

4.2 The application was admitted and called for final online hearing on 14.12.2021. Shri. Yash Ladda, learned CA and Shri Chirag Mehta, learned CA, appeared, made oral and written submissions. Jurisdictional Officer Shri Sunil Wankhedkar, learned Superintendent Div II, Swargate attended and made oral and written submissions.

4.3 We heard both the sides.

05. OBSERVATIONS AND FINDINGS:

5.1 We have perused the documents on record and considered the oral and written submissions made by both, the applicant as well as the jurisdictional officer.

5.2 The Applicant is engaged in drilling and blasting works at various sites using Industrial explosives and other materials. Government of Maharashtra has entrusted to Maharashtra State Road Development Corporation Limited (MSRDC), the development, operation and maintenance of Two Tunnel (Two Tubes of four lane each) for Missing Link under Capacity Augmentation of Mumbai Pune Expressway in the State of Maharashtra in pursuance of which, MSRDC entered into an Engineering, Procurement and Construction Agreement on 11th of October 2018 with M/s Navyauga Engineering Company Limited (NECL).

5.3 NECL further engaged the applicant through a sub-contracting arrangement for the said work relating to construction of tunnel by drilling and blasting method and issued a work order for subject work.

5.4 We find that, the work awarded to the main contractor viz. NECL is, construction of Tunnel and Approach roads. In order to complete the said EPC contract, the main contractor has engaged the applicant as a sub-contractor for drilling and blasting work for rock tunneling. The applicant has submitted the general cycle of drilling and blasting activity in their submissions.

5.5 After going through the above processes, it is clear that various goods including explosives, tools and other material have to be used during the process of blasting. Hence there is an element of goods involved in the said transaction. Further, there is a service element also in carrying out the whole process starting from drilling till the end by removing the rubble. Hence the activity involves both, the goods as well as the services.

5.6 Section 2(30) of the CGST Act, 2017, defines the term ‘composite supply’ as under:-

(30) “composite supply” means a supply made by a taxable person to a recipient consisting of two or more taxable supplies of goods or services or both, or any combination thereof, which are naturally bundled and supplied in conjunction with each other in the ordinary course of business, one of which is a principal supply.

5.7 The applicant has been issued a Work Order dated 28.11.2018 by M/s Navyauga Engineering Company Limited, the Main Contractor for “drilling and blasting including all tools, materials, explosive vans etc. complete for approach roads and Tunnel Works”. The applicant has also submitted an Addendum to the aforementioned Work Order as per which: The said work entrusted to the applicant shall be in relation to the construction of Two Tunnels for missing link under Capacity Augmentation of Mumbai Pune Expressway in Mumbai and the impugned work awarded, shall include within its ambit various goods including explosives tools and other material to be used during the work.

From the work diagram submitted by the applicant and oral submissions made by applicant, we also observe that, after the blasting work is done the applicant also undertakes scaling work of the crown and walls to remove loosened pieces of rock, furthermore the applicant bolts the crown with materials for support and installs initial ground support.

5.8 Thus, the applicant as per their own submissions, undertakes the construction of tunnel by drilling and blasting techniques at site using tools, materials, explosive vans and other materials etc. We therefore find that, in the subject case, there is definitely involvement of supply of services in the form of drilling and blasting and clearing of rubble etc. We also find that to perform such services there is requirements of goods which include explosives. The service of drilling and blasting cannot be conducted without the use of explosives and therefore we find that there is an element of composite supply in the present case.

5.9.1 The first question raised by the applicant is whether the impugned activity to be carried out by the applicant shall be classified as supply of goods or services or a composite supply of ‘works’ contract’.

5.9.2 From the submissions made by the applicant we observe that the main contractor has been given a contract by MSRDC to construct tunnels for Mumbai Pune Expressway and accordingly, the main contractor has subcontracted the tunneling work to the applicant by way of drill and blast technique of tunneling. In the subject case, the work is for construction of tunnels which can be considered as immovable properties belonging to the Government of Maharashtra. Further as per the work order submitted by the applicant, it clearly appears that the impugned activity carried out by the applicant can classified as composite supply of works contract for construction of tunnel. This would answer the first question raised by the applicant.

5.10.1 The second question raised by the applicant is whether the impugned activity should be classified as Composite Supply of works contract for Construction of tunnel under Entry 3 (iv) of Notification No. 11/2017-CT (Rate) dated 28.06.2017 taxable at the rate of 12%?

5.10.2 In our above discussions we observe that the impugned activity/supply undertaken by the applicant as per the subject Work Order received from M/s NECL is “drilling and blasting including all tools, materials, explosive vans etc. complete for approach roads and Tunnel Works”. Since, we have held that the impugned activity carried out by the applicant can be classified as composite supply of works contract for construction of tunnel we find that the said supply will be covered under Entry 3(iv) of Notification No. 11/2017-CT (Rate) dated 28.06.2017 which is reproduced as under:-

| Sr. No. | Chapter, Section or Heading | Description of services | Rate % | Condition |

| 3 | Heading 9954 Construction Services | (iv) Composite supply of works contract as defined in clause (119) of section 2 of the Central Goods and Services Tax Act, 2017, supplied by way of construction, erection, commissioning, installation, completion, fitting out, repair, maintenance, renovation, or alteration of,- (a) a road, bridge, tunnel, or terminal for road transportation for use by general public; (b)……………………. (c)……………………. (d)……………………. (e)……………………. (f)……………………. | 6 | |

5.10.3 It is further noticed that similar view has been taken by the Advance Ruling Authority of Gujarat in case of M/s KHEDUT HAT [2018-TIOL-173-AAR-GST] that blasting work with use of explosives is a composite supply.

5.10.4 Hence, in respect of the second question asked by the applicant, we hold that the impugned activity carried out by the applicant is a composite supply of works contract for construction of tunnel and is covered under Entry 3(iv) of Notification No. 11/2017-CT (Rate) dated 28.06.2017. The relevant facts, opinions and the case laws submitted by the applicant as well as the department are considered for arriving at the decision.

06. In view of the discussions made hereinabove, we pass an order as follows:

ORDER

(Under Section 98 of the Central Goods and Services Tax Act, 2017 and the Maharashtra Goods and Services Tax Act, 2017)

For reasons as discussed in the body of the order, the questions are answered thus –

Question 1: Whether the activity to be carried by the applicant shall be classified as supply of goods or services or a composite supply of ‘works’ contract’?

Answer: The impugned activity carried out by the applicant is a ‘composite supply’ of works contract.

Question 2: Whether the activity should be classified as Composite Supply of works contract for Construction of tunnel under Entry 3(iv) of Notification No. 11/2017-CT (Rate) dated 28.06.2017 taxable at the rate of 12%?

Answer: Answered in the affirmative.

Prices of BUSY Increasing from 1st June, 2024. Click Here

Prices of BUSY Increasing from 1st June, 2024. Click Here