ORDER ORDER

1. This report, dated 06.12.2018, has been received by this Authority from the Director General of Anti-Profiteering (DGAP) under Rule 129 (6) of the Central Goods and Service Tax (CGST) Rules, 2017. The brief facts of the present case are that an application was filed by the Applicant No. 1 before the Standing Committee on Anti-profiteering, alleging profiteering by the Respondent on the supply of the product, namely, “Washing Machine (Elena Aqua VX)” (here-in referred to as the product), by not passing on the benefit of reduction in the rate of tax on the impugned product, post introduction of GST w.e.f. 01.07.2017. in this regard; the Applicant No. 1 had relied on two invoices issued by the Respondent, one dated 31.05.2017 (pre-GST) and the other dated 04.08.2017 (post-GST), the details of which have been given in the Table below:-

Table – A

(Amount in Rs.)

| S.No. | Name of the product supplied | Pre-GST rate before 01.07.2017 | Post GST rate on 01.07.2017 | Difference (in Rs.) |

| Invoice No. & Date | Total Tax | Total Price (in Rs.) | Invoice No. & Date | GST rate | Total Price (in Rs.) |

| 1. | Washing Machine (EIena Aqua VX) (HSN-84501100) | 3220057999 dated 31.05.2017 | Central Excise duty @ 12.5% the MRP with 35% abetement + [email protected]% | 18157/-(base price-13624/-) | 3220059299 dated 04.08.2017 | 28% | 23922 (base price-18689/ | 5765/- (base price diff.-5065/-) |

2. The said complaint was examined by the Standing Committee and vide minutes of its meeting dated 02.07.2018; it requested the DGAP to initiate investigation under Rule 129 (1) of the CGST Rules, 2017 and to conduct a detailed investigation in the matter.

3. In this connection, a Notice under Rule 129 of the CGST Rules, 2017, was issued on 10.09.2018 by the DGAP to the Respondent, directing the Respondent to intimate as to whether he admitted that the benefit of reduction in the tax rate had not been passed on to the recipients by way of commensurate reduction in price. The Respondent was also asked to suo- moto determine the quantum of benefit not passed on, if any, and indicate the same in his reply to the Notice issued by the DGAP. Certain documents, viz., Balance sheet, GST Returns (1&3B), price list, details of outward taxable supplies of the impugned product in the country, etc, were also sought from the Respondent by the DGAP.

4. The DGAP requested this Authority for grant of extension in time to complete the investigation up to 09.12.2018 which was allowed by this Authority under Rule 129 (6) of the CGST Rules, vide its order dated 09.10.2018. The present investigation pertains to the period between 01.07,2017 to 31.08.2018.

5. The DGAP, in his Report, has stated that the Respondent in replies to his notice had submitted that he had not increased the price while migrating from VAT regime to GST. A copy of an invoice dated 31.05.2017 for sale of the impugned product to a dealer under the erstwhile VAT regime was also furnished by the Respondent. The Respondent further submitted that he was selling his products to the various dealers by offering different discounts under different schemes and the discounts were given in two parts, one on the original invoice of the material and the second was periodical accumulated discount (Monthly) passed in subsequent invoices. It was also submitted by the Respondent that the product was sold after offering accumulated discount of ₹ 6,0341- per unit for the dealer and hence, the taxable value was ₹ 13,624/-(Monthly scheme for April and May, 2017). He further submitted that in the Invoice dated 04,08.2017, the taxable basic value was higher (₹ 18,689/-) post-GST since there was no accumulated discount. It was further stated that in all other invoices billed to the party during the pre-GST period, the basic taxable value was higher and the basic taxable value was less only due to passing on the accumulated discount in the invoice which is related to earlier purchases. He further submitted that there was no change in the MRP of the product after GST and he had maintained the same price although the taxable basic value had been reduced and the tax incidence had increased after introduction of GST. He further stated that his factory was situated in Goa and the entire range of products was sold through his branches in different States. In the pre-GST period, the products were stock transferred to his various branches in other States by discharging applicable Central Excise Duty at the time of removal of goods from the factory and he did not charge VAT on the same. In lieu of CST on his stock transferred to other States, the Respondent was reversing the credit of VAT taken on the raw material/inputs used in the manufacture of the product which was amounting to ₹ 24.34 per unit of the product. 6. The Respondent also submitted the Table given below:-

Table-B

(Amount in Rs.)

| Details | Pre GST period | Post GST Period |

| MRP | 27,490.00 | 27,490.00 |

| Excise duty | 2,233.56 | |

| [email protected]% | 3,481.27 | |

| [email protected]% | | 6,013.44 |

| Total Taxes | 5,714.83 | 6,013.44 |

| Basic Price | 21,775.17 | 21,476.56 |

| Reduction in Basic Price | 298.61 |

7. The Respondent also furnished the following documents to the DGAP:-

i. Invoice-wise details of outwards taxable supplies of the product “Washing machine Elena Aqua VX” on All-India basis for the period April, 2017 to August, 2018.

ii. Price list of the product under investigation, pre-GST and post-GST,

iii. Sample copies of invoices, pre-GST and post-GST.

iv. GSTR-1 and GSTR-3B Returns for the period July, 2017 to August, 2018.

v. TRAN-1 and TRAN-2 Statements from July, 2017 to December, 2017.

vi. VAT Return including Annexure from April, 2017 to June, 2017.

vii. ST-3 Returns for 2016-17 and 2017-18.

viii. Applicable tax rates, pre-GST and post-GST.

ix. Sample copies of invoices issued by M/s IFB Industries Ltd., indicating Central Excise Duty & VAT Separately.

x. Details of total adjusted discount given month wise to M/s Pittapilli Agencies against the invoices/ total sales value.

xi. Details of reversal of VAT credit at Goa, in lieu of CST payable on stock-transfer to other States

8. The DGAP examined the application filed by the Applicant No. 1, the reply of the Respondent and the documents/evidences on record and observed that the main issues to be looked into were whether there was a reduction in the rate of tax on the product post introduction of GST w.e.f. 01.07.2017 and if so, whether the benefit of such reduction in the rate of tax had been passed on by the Respondent to the recipients, in terms of Section 171 of the Central Goods and Services Tax Act, 2017.

9. DGAP further examined Section 171 of CGST Act, 2017 which governs the anti-profiteering provisions under GST and stated that the Section 171(1) of CGST Act, 2017 reads as under:-

“Any reduction in rate of tax on any supply of goods or services or the benefit of input tax credit shall be passed on to the recipient by way of commensurate reduction in prices.”

10. The DGAP further observed that the issue that remained was the determination and quantification of profiteering by the Respondent for failing to pass on the benefit of the reduction in the rate of tax to the consumers in terms of Section 171 of the Central Goods and Services Tax Act, 2017.

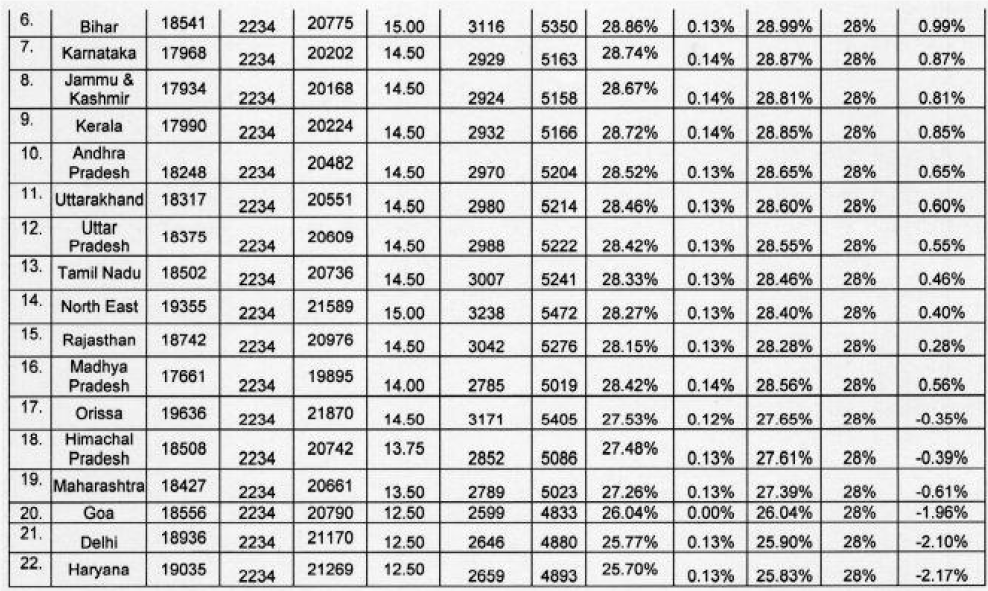

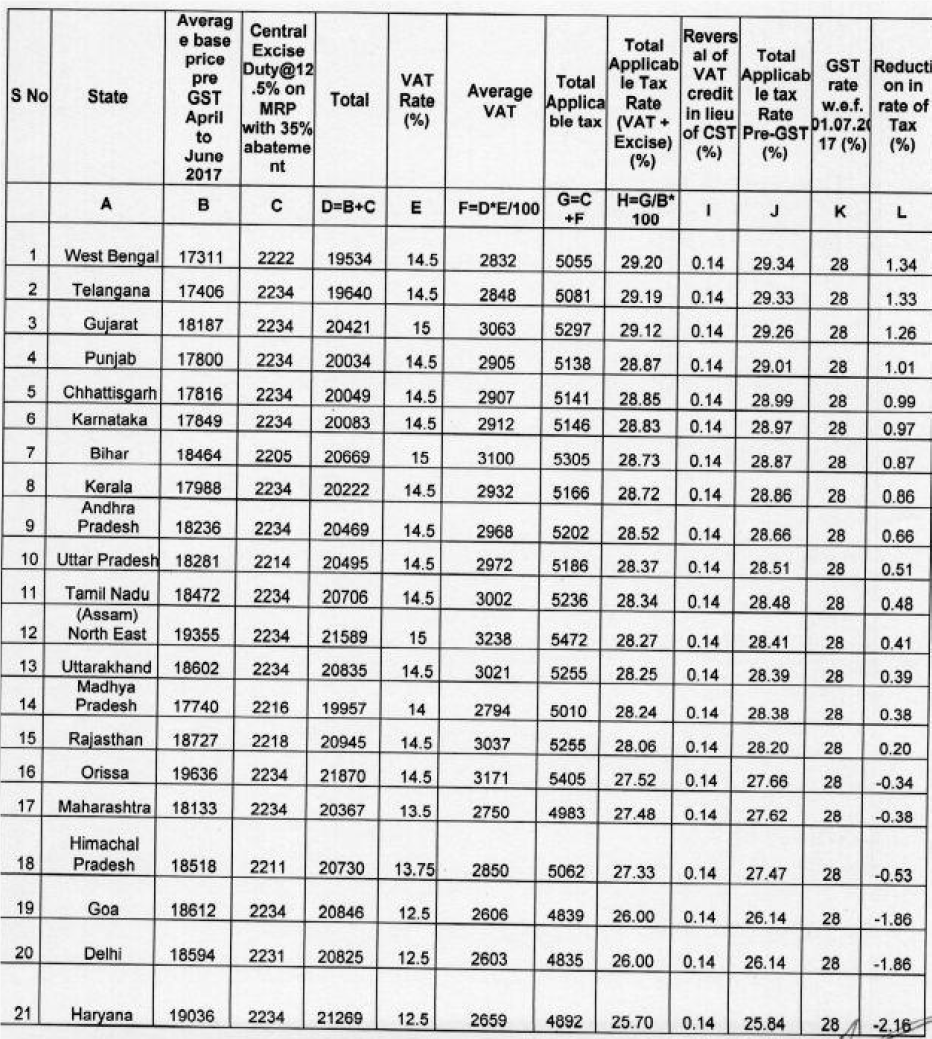

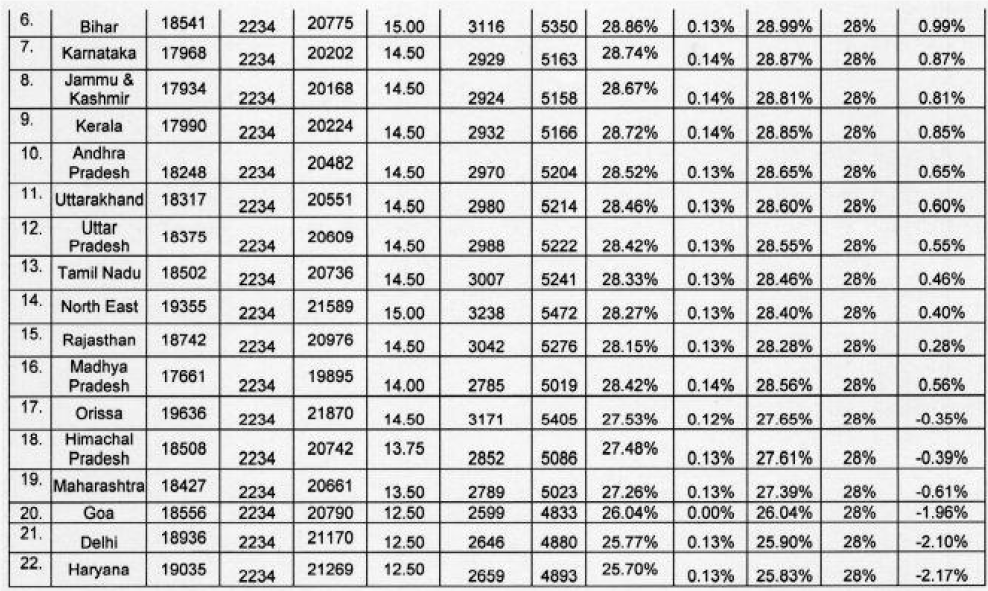

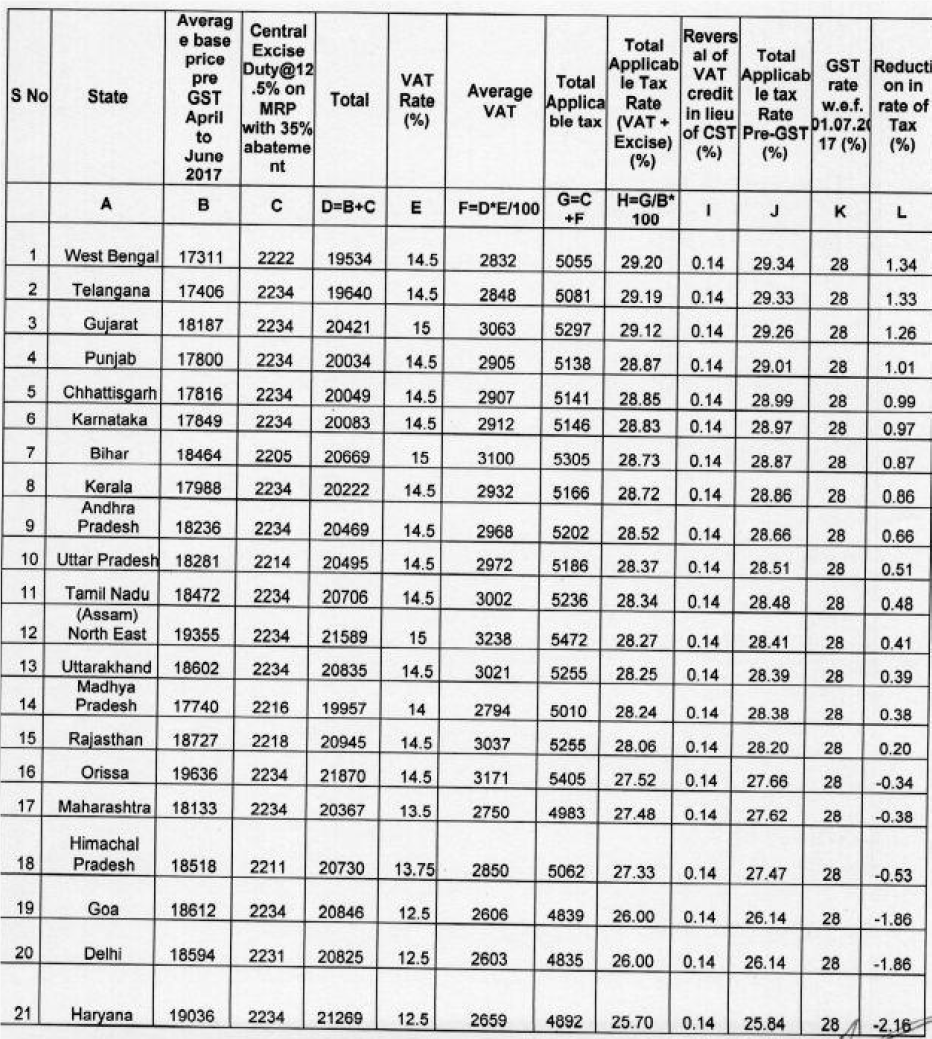

11. The DGAP, after going through the State-wise sale details submitted by the Respondent, observed that there was a reduction in the applicable rate of tax in the post-GST period as compared to the pre-GST period in most of the States. The same has been explained in the Table given below:-

Table C

(Amount in Rs.)

12. The DGAP, from the above table observed that there was a reduction in the rate of tax in respect of States mentioned at S. No. 1 to 16, post introduction of GST w.e.f. 01 07 2017. On the basis of aforesaid pre and post-GST tax rates and the details of outward supplies of the impugned product to the States mentioned at S, Nos. 1 to 16 of Table, during the period 01.07.2017 to 31.08.2018 furnished by the Respondent, the amount of net higher sale realization due to increase in the base price of the product, despite the reduction in the rate of tax post implementation of GST 01.07.2017, or, the profiteered amount was computed as Rs, 51, 04,002/-. The profiteered amount had been arrived at by comparing the State-wise average base price of the impugned product during the period 01,04.2017 to 30.06.2017, with the actual transaction-wise base prices during the period 01.07.2017 to 31.08,2018.

13. The DGAP also furnished a Table in respect of the place of supply of the total profiteered amount:-

Table-D

(Amount in Rs.)

| S.No. | State Code | State (Place of Supply) | Profiteering (Rs.) |

| 1. | 1 | Jammu & Kashmir | 9261 |

| 2. | 3 | Punjab | 16904 |

| 3. | 5 | Uttarakhand | 4690 |

| 4. | 8 | Rajasthan | 641 |

| 5. | 9 | Uttar Pradesh | 28509 |

| 6. | 10 | Bihar | 19987 |

| 7. | 18 | Assam | 1756 |

| 8. | 19 | West Bengal | 30045 |

| 9. | 22 | Chhattisgarh | 26000 |

| 10. | 23 | Madhya Pradesh | 110908 |

| 11. | 24 | Gujarat | 220645 |

| 12. | 29 | Karnataka | 108786 |

| 13. | 32 | Kerala | 2775386 |

| 14. | 33 | Tamil Nadu | 1568332 |

| 15. | 36 | Telengana | 62849 |

| 16. | 37 | Andhra Pradesh New | 119304 |

| Total | 51,04,002 |

14. The DGAP thus concluded that the base price of the product under investigation was increased after 01.07.2017. Thus, by increasing the base price of the product consequent to the reduction in the tax rate, the commensurate benefit of the reduction in tax rate post implementation of GST w.e.f. 01.07.2017, was not passed on to the recipients and accordingly, the total amount of profiteering covering the period 01.07.2017 to 31.08.2018 had been calculated as ₹ 51,04,002/-.

15. The above Report was received on 07.12,2018 and was considered by the Authority in its sifting held on 11.12.2018 and it was decided to hear the Applicants and the Respondents on 03.01.2019. The hearing was further adjourned to 11.01.2019 upon the Respondent’s request vide his letter dated 27.12.2018.

16. During the hearings held on 11.01.2019, 07.02.2019, 20.02.2019, 27.02.2019, 23.04.2019, 21.05.2019 and 12.06.2019, none appeared on behalf of the Applicant No. 1; the Applicant No. 2 was represented by Smt. Gayatri, Deputy Commissioner; the Respondent was represented by Sh. Siddhartha Jain, Consultant, Sh. Ashish Singh, DGM (Finance), Sh. Anirban Ganguly, Head- Indirect Tax, Sh. Amit Tibrewal, Consultant and Sh. Arijit Ghosh, Deputy Manager.

17. The Respondent filed his first written submissions on 11.01.2019. Vide his submissions, he stated that

(a) That the proceeding of the DGAP was based on incorrect understanding of facts and was against the principles of anti-profiteering under GST and the law laid down by the Authority; That various details and documents sought by DGAP had been submitted from time to time; That it had been explained to the DGAP that the base price of the said product, as charged from his dealer (M/s. Pittapilli Agencies), had actually been reduced from ₹ 21,7751- (pre-GST) to ₹ 21,4761- (post-GST); That the difference in prices pointed out by DGAP was only due to discounts and incentive schemes offered by him to his dealers, and that the details of the same were as below:-

Table –E

(Amount in Rs.)

| Product [Elena Aqua VX] | Pre-GST | Post-GST |

| Invoice No. 3220057999 dated 31-05-2017 | Invoice No. 3220059299 dated 04-08-2017 |

| Base Price as per Invoice | 24,009 | 21,476 |

| Excise Duty [INR 2,234/- per unit considered by DGAP] | (-) 2,234 | – |

| Base Price [excluding all tax elements] | 21,776 | 21,476 |

| Trade Discount as per invoice | 2,881 | 2,786 |

| Net Price Charged | 18,894 | 18,690 |

(b) That even if the element of Central Excise Duty, as computed by the DGAP, was removed from the above Table computation, the base price charged under the GST was lower than the base price in the pre-GST regime; and the price of the product in pre and post-GST regime be analysed on the basis of the base prices and without considering discounts. The Respondent also cited the precedence of the outcomes in the case of Kerala State Screening Committee and another Vs. M/s Asian Paints Ltd. In Case No. 29/2018 decided on 27.12.2018 by the Authority, according to which base prices of the product in the pre and post GST regime shall be analysed and changes in price arising due to discounts, offered by the manufacturer from its margin, should not be considered for the propose of provisions of Section 171 of the CGST Act, 2017.

(c) That it was clear that in his case the base price was reduced in GST regime and therefore the question of profiteering did not arise, and that the DGAP had failed to understand the correct perspective of Law. He contended that in several cases where it was found that the base price has been reduced or remained same or the tax percentage for referred transaction had not been reduced, the enquiry under Section 171 of the CGST Act had been dropped at that stage itself. The Respondent cited the case of Kerala State Screening Committee and another Vs. M/s Peps Industries Pvt. Ltd in Case No. 22/2018 decided on 27.09.2018 and in the case of Kerala State Screening Committee and another Vs. M/s. Maruti Suzuki India Ltd. in Case No. 01/2019 decided on 02.01.2019 passed by this Authority

(d) That since in his case. the tax rate on the said product had increased under GST, hence, provisions of Section 171 of the CGST Act were not attracted, as was evident from the fact that in the pre-GST regime, the product was subject to Central Excise Duty @12.5% on 65% of MRP and VAT in general (most of the States) was chargeable @14,5%. Thus, the total tax rate applicable for the product in pre-GST regime basis the MRP was 26.40%, which showed that his was a case of increase in the rate of tax to 28%. He also submitted a Table for the same which is given below:-

Table-F

(Amount in Rs.)

| Product [Elena Aqua VX] | Pre-GST | Post-GST |

| MRP | 27,490 | 27,490 |

| VAT [@14.5%, included in MRP] | 3,481 | – |

| Excise Duty [@12.5% on 65% of MRP, included in IMP] | 2,234 | – |

| GST [@28%, included in MRP] | | 6,013 |

| Total Tax on the Product | 5,715 | 6,013 |

| Price Net of Tax | 21,775 | 21,477 |

| Tax on safes [as percentage of Net Price] | 26.24% | 28% |

| Tax on purchases [VAT reversal as considered by DGAP] | 0.14% | – |

| Total tax incidence on product | 26.40% | 28% |

(e) That, since MRP for the product was not increased even when rate of tax, post introduction of GST, was increased from 26.4% to 28%, it was clear that the interest of the consumers had been duly protected.

(f) That, even if it was assumed but not admitted that expansion of investigation by the °GAP was valid, the computation of profiteering should have been on the basis of prices charged at a pan India level and not based on prices charged in specific states and specific transactions, since the rationale for anti-profiteering provision was to check that benefit, if any, arising due to introduction of GST was passed on to end consumers and that the expression ‘commensurate reduction in prices of the goods’ as used in Section 171 of the CGST Act should have been considered for overall reduction in prices and that such expression should not be limited to specific transactions, as in each case the prices depended on independent negotiations with customers/ dealers. Further, he argued that there was no prescription either under the CGST Act or the Rules that GST benefits have to be seen for each State separately, The Respondent further submitted that independent changes in price in each and every sale transaction was not always due to tax factor and was not relevant for computing the overall impact of GST on a product and that each change in the negotiated price cannot be considered as profit arising due to GST. He added that a holistic approach ought to have been taken considering the overall scheme, intention and objective of anti-profiteering provision.

(g) That even if it was assumed that the impact shall be analysed for each ‘registered person’ i.e., for each GST registration each State, then also, the computation done by the DGAP was principally incorrect, since the instant enquiry was meant only for the State of Kerala and hence, the inclusion of certain other States in the study and exclusion of some others was unjustified. Also that the DGAP had not limited his enquiry to the concerned registered person [IFB Kerala] but had prepared the report at Company level but had still not considered the entire sales of the said product Further if the DGAP had intended to limit his enquiry to specific registered person i.e., IFB Kerala, the impact of taxes paid in other States i.e., in manufacturing State (Goa) for excise duty and VAT reversal in pre-GST regime, ought not have been considered and the analysis should have been limited to pre-GST and post GST tax payments in Kerala only.

(h) That even it was assumed but not admitted that the contention of the DGAP was correct, the computation in the report was erroneous and amount of alleged profiteering determined therein was incorrect as even for the 16 States, that had been considered by the DGAP, the question of any profiteering did not arise at all in the present case. The basis adopted by DGAP for comparing the prices post introduction of GST i.e. by comparing the average selling price for pre-GST period i.e., during April ‘17 to June ‘17 for each State with the actual selling price for post GST transactions during July 2017 to Aug 2018 was erroneous. He further submitted that in case the average price had been considered for pre-GST period, then average prices for post GST period should have been taken for the computation.

(i) That while comparing the average price for pre-GST period with sales transactions in post GST regime, sales made in GST period at price lower than pre-GST average price had been ignored. He also submitted that certain specific sales transactions (employee sales and exchange sales) have been included in computation for pre-GST period but excluded for post GST period. He also submitted that changes in MRP w.e.f. 8th June, 2018, which resulted in consequent change in base price as well had been completely ignored and computation had been made for sale transactions for the period beyond 8th June 18 [i.e., 8th June, 2018 to 31st August, 2018], which were not comparable and during the pre GST as well as post GST period up to 07-06-2018, the MRP remained at ₹ 27,490/- and w.e.f. 08-07-2018, MRP of the impugned product has been changed to ₹ 28,490/-.

(j) Once the aforesaid errors were corrected, the position would be as follows, he has claimed:-

Table-G

(Amount in Rs.)

| State | Average price as per DGAP report | Pre-GST [1st April ’17 to 30th June ‘17] | Post-GST [1st July ’17 to 8th June ‘18] | Difference between Pre & Post GST Average Prices |

| Sales Realisation | Quantity Sold | Actual Average Price | Sales Realisation | Quantity Sold | Actual Average Price |

| A | B | C | D=B/C | E | F | G=E/F | H=G-D |

| Kerala | 17,990 | 2,43,54,752 | 1,353 | 18,001 | 10,19,32,849 | 5,700 | 17,883 | -118 |

| Tamil Nadu | 18,502 | 1,16,00,470 | 628 | 18,472 | 5,56,00,418 | 3,012 | 18,460 | -12 |

| Gujarat | 18,435 | 71,31,167 | 392 | 18,192 | 2,78,89,002 | 1,550 | 17,993 | -199 |

| Karnataka | 17,968 | 23,91,706 | 134 | 17,849 | 1,10,30,882 | 622 | 17,735 | -114 |

| Andhra Pradesh | 18,248 | 12,94,720 | 71 | 18,235 | 61,62,499 | 341 | 18,072 | -164 |

| UP | 18,375 | 12,41,765 | 68 | 18,261 | 46,49,206 | 260 | 17,882 | -380 |

| Telangana | 17,511 | 2,26,275 | 13 | 17,406 | 26,36,271 | 150 | 17,575 | 169 |

| Madhya Pradesh | 17,661 | 3,36,733 | 19 | 17,723 | 15,41,382 | 82 | 18,797 | 1,075 |

| Bihar | 18,541 | 1,84,349 | 10 | 18,435 | 12,72,755 | 69 | 18,446 | 11 |

| West Bengal | 17,328 | 5,70,898 | 33 | 17,300 | 10,86,370 | 62 | 17,522 | 222 |

| Chhattisgarh | 17,815 | 1,60,339 | 9 | 17,815 | 10,26,438 | 67 | 18,043 | 227 |

| Punjab | 17,760 | 71,199 | 4 | 17,800 | 8,98,137 | 50 | 17,963 | 163 |

| Uttarakhand | 18,317 | 74,404 | 4 | 18,601 | 6,33,744 | 35 | 18,107 | -494 |

| North East | 19,335 | 58,066 | 3 | 19,355 | 3,78,782 | 20 | 18,939 | -416 |

| Rajasthan | 18,742 | 1,49,694 | 8 | 18,712 | 3,29,116 | 18 | 18,284 | -427 |

| J & K | 17,934 | | | | 2,94,425 | 16 | 18,402 | |

Thus, from the above table, it was clear that:-

(i) For each of the State, the pre-GST average price as stated in DGAP’s report was incorrect;

(ii) Prices for the product had decreased in most of the states during post GST period, as indicated in above table.

(iii) The states wherever the positive differences were coming out, the sates in terms of quantity were minimal as compared to total sales of the product by the Respondent and such cases should not be considered.

Thus, he has submitted that it could be seen that no profiteering was involved and the positive figure as computed in the DGAP report was arising only due to arithmetical errors in deriving the average and not considering certain transactions etc. He also submitted the state wise summary of the revised figure which is as follows:-

Table -H

(Amount in Rs.)

| S.No. | State code | State | As per DGAP Report | Revised working modifying the aforesaid errors |

| Average Price | Alleged Profiteering amount |

| 1 | 32 | Kerala | 17,990 | 27,75,386 | -6,70,319 |

| 2 | 33 | Tamil Nadu | 18,502 | 15,68,332 | -37,503 |

| 3 | 24 | Gujarat | 18,435 | 2,20,645 | -3,08,213 |

| 4 | 29 | Karnataka | 17,968 | 1,08,786 | -70,918 |

| 5 | 37 | Andhra Pradesh | 18,248 | 1,19,304 | -55,806 |

| 6 | 9 | Uttar Pradesh | 18,375 | 28,509 | -98,718 |

| 7 | 36 | Telangana | 17,511 | 62,849 | 25,400 |

| 8 | 23 | Madhya Pradesh | 17,661 | 1,10,908 | 88,111 |

| 9 | 10 | Bihar | 18,541 | 19,987 | 748 |

| 10 | 19 | West Bengal | 17,328 | 30,045 | 13,774 |

| 11 | 22 | Chhattisgarh | 17,815 | 26,000 | 12,957 |

| 12 | 3 | Punjab | 17,760 | 16,904 | 8,153 |

| 13 | 5 | Uttarakhand | 18,317 | 4,690 | -17,295 |

| 14 | 18 | North East | 19,335 | 1,756 | -8,324 |

| 15 | 8 | Rajasthan | 18,742 | 641 | -7,695 |

| 16 | 1 | Jammu & Kashmir | – | 9,261 | – |

| Sub-total for 16 states [as considered by DGAP] | | 51,04,002 | -11,25,648 |

| 17 | 30 | Goa | 18,556 | – | -6,16,043 |

| 18 | 07 | Delhi | 18,930 | – | -2,39,257 |

| 19 | 27 | Maharashtra | 18,427 | – | -91,926 |

| 20 | 21 | Orissa | 19,636 | – | -17,418 |

| 21 | 06 | Haryana | 19,035 | – | -136 |

| 22 | 02 | Himachal Pradesh | 18,508 | – | 1,321 |

| Subtotal for balance 6 states (Not considered by DGAP] | | | -9,63,458 |

Thus, it was clear that, the manner of computation adopted in the report submitted by DGAP was incorrect and the question of any profiteering on the product due to GST did not arise.

(k) He also submitted that since any methodology and procedure for determining the anti-profiteering amount was not prescribed by Legislature, he could not be held liable in this regard. He also submitted that while the provisions were brought into effect from 01.07,2017, the Cabinet approved the creation of the posts of Chairman and Technical Members of the Authority on 16.11.2017 and the members were appointed on 28.11.2017. He also cited the Rule 126 of the CGST Rules, 2017 which empowered the Authority to determine the methodology and procedure for determination as to whether the reduction in rate of tax on supply of goods or services or benefit of input tax credit had been passed on by the registered person to the recipient by way of commensurate reduction in prices. He further mentioned that no such guidelines had been framed by the Authority yet, leaving the issue in complete discretion of the authorities with no guidance to a registered person under the Act. Further, no directions had also been issued under the Act. In absence of the guidelines as prescribed under Rule 126, a registered person cannot be held, liable for not complying with requirements of Section 171.The Respondent also submitted that the provisions of Section 171 of the CGST, Act and Rule 122 to 137 being part of a taxing Statute, cannot be enforced in absence of machinery provisions for computation of the profiteered amount. In this regard, he also cited the judgments of the Hon’ble Supreme Court in the cases of CIT vs. B. C. Srinivasa Shetty [(1991) 2 SCC 460] and Commissioner of Central Excise vs Larsen & Toubro Ltd. [(2016) 1 SCC 170], wherein the said principal has been considered by the Hon’ble Court and held that the provisions of the Statute could not be enforced in the absence of machinery provision.

(I) No mechanism/ guideline had been prescribed as to whether the price alteration was required to be done at entity level, State level, product level, SKU level, category level, each of which would bring a different result and there was no guidance whether commensurate change in price would be assessed in absolute terms or as trend or in percentage terms. Further, any initiation of proceeding in present case, when ultimately tax on the product had increased post introduction of the GST regime was also legally unsustainable.

(m) The computation of any profiteering based on sale prices and assumption of any increase in sale price as profiteering under GST laws without considering any efficiency in the operations, commercial negotiations, etc., was incorrect and unjustified since a mere change in rate of tax could not be considered as profit which would necessitate reduction in price and that the business of dealer and impact of changes on supply chain ought to be seen as a whole for the purposes of Section 171 of the Act. He also mentioned that it was also imperative to note that GST had also led to various increases in costs like increase in working capital costs, cost of GST implementation, etc., which had been totally ignored.

(n) That the expansion of proceedings by DGAP beyond the state of Kerala was without jurisdiction and the submission of report by DGAP, without granting any opportunity for personal hearing to the Respondent, was against the principle of natural justice more so, since he had submitted all requisite documents and information as solicited by the DGAP. Also that the scope of the instant proceeding should have been restricted to the Applicant No. 1 and the registered person in respect of the said product. Both the initiation and conduct of proceedings under Rule 129 and order under Rule 133 was in respect of `the recipient” and a registered person’. He also stated that the use of the term ‘the’ clearly indicated that the reference was to a particular recipient of goods and services and not generally to all recipients. Further, as proceedings before the Authority were adversarial in nature, the proceedings had to be seen as being in respect of the Applicant No. 1 and a registered person and would not cover any other transaction. He also intimated that the matter had been referred by the Screening Committee in the State of Kerala based on certain application filed by the Commissioner, CGST Department, Kerala referring to the transaction with a particular dealer.

(o) The Respondent also submitted that in the instant case, since no profiteering was involved the question of invocation of any of the penal provisions did not arise and hence, he is not going into specific submissions in respect of each of penal previsions specified in the notice. He added that GST was a new Statute and since the Legislature had not notified any methodology for determination of the profiteering amount, the question of invocation of any penal actions in such a scenario did not arise.

(p) There were no provisions in the Act for penal action as provided in the Rule 133 and that it was well settled principle that the Rules can only provide for procedural provisions and hence, the Rule cannot go beyond the provisions of the Act and hence, there can be no invocation of the penal provisions in the present case. He also cited the judgements of Kunj Behari Lal & Ors. v. State of H.P. 2000 (3) SCC 40, wherein it was held that the legislature cannot create any substantive rights or obligations or disabilities through general rule making powers unless the same was specifically contemplated by the provisions of the Act under which such powers were exercised. He also cited the case of Petroleum and Natural Gas Regulatory Board vs. Indraprastha Gas Limited & Ors. (2015) 9 SCC 209, wherein it had been held that if on reading of the statute in entirety, a power did not flow, a delegated authority could not frame a regulation that would not be in accordance with the statutory provisions.

18. The DGAP vide his Report dated 30.01.2019 on the submissions made by the Respondent dated 11.01.2019, reported that only those invoices had been taken into consideration where the post-GST discounted base price was more than the pre-GST discounted base price. The invoices where the post-GST discounted base price was less than the pre-GST discounted base price, had not been considered by DGAP. Regarding the Respondent’s contention of the modalities and mechanism of anti-profiteering, the DGAP reported that the Respondent had mentioned that there was no guideline / methodology for ascertaining the quantum of “profiteering” by the supplier. In this regard, it might be seen that as per Rule 126 of the CGST Rules, 2017, the Authority has been empowered to determine the methodology and procedure for determination as to whether the reduction in the rate of tax or the benefit of input tax credit has been passed on by the registered person to the recipients by way of commensurate reduction in prices. Regarding the contention of expansion of proceeding by DGAP was without jurisdiction and submission of report by DGAP without granting any opportunity for personal hearing to the Respondent was against the principle of natural justice, the DGAP mentioned that there was nothing in the existing statutory provisions which would confine the scope of investigation to the State in which profiteering had been alleged or to the dealer whose purchase invoice had been relied upon to allege profiteering. In the context of the Respondent’s submission relating to the tax structure in different states during the pre & post-GST regime, the DGAP reported that Central Excise Duty incidence of 8.125% was as a percentage of the MRP (12.5% of 65% of MRP) and not as a percentage of the discounted base price, which was required to be compared with the post-GST tax rate of 28%. The DGAP in his report dated 06.12.2018 had mentioned that the total incidence of Central Excise Duty and VAT had been calculated as a percentage of pre-GST discounted base price and same had been compared with the post-GST tax rate of 28%. The details of entry tax/octroi etc., now claimed by the Respondent, were not submitted during the course of investigation.

19. The Respondent filed his next written submissions on 12.02.2019. Vide his submissions, he conveyed his disagreement with the DGAP Report dated 30.01.2019 and submitted the following:-

(a) That in the pre-GST regime, effective tax rate was lower than the post-GST regime in practically all the States which was evident from the table below, which also gave the details of the pre-discounted tax rates of the product in pre-GST period (aggregate of ED, VAT, Entry Tax, Local Levies etc) which showed that the post-GST tax rate was more than the pre-GST tax rates, as per the Table-I below:-

Table-I

(Amount in Rs.)

| SI. No. | State | % Sales of Elena Aqua-VX | Pre-discount Rate of Tax in Pre-GST period* |

| 1. | Goa | 6.3% | 23.85% |

| 2. | Delhi | 2.5% | 25.07% |

| 3. | Maharashtra | 4.6% | 25.13% |

| 4 | Himachal Pradesh | 0.2% | 25.57% |

| 5 | Andhra Pradesh | 2.5% | 26.25% |

| 6 | Kerala | 40.8% | 26.25% |

| 7 | Tamil Nadu | 21.6% | 26.34% |

| 8 | Karnataka | 4.5% | 26.53% |

| 9 | Uttar Pradesh | 1.9% | 26.70% |

| 10 | Gujarat | 11.1% | 26.81% |

| 11 | Bihar | 0.5% | 27.10% |

| 12 | North East | 0.1% | 27.10% |

| 13 | Chhattisgarh | 0.4% | 27.25% |

| 14 | Rajasthan | 0.1% | 27.73% |

| 15 | West Bengal | 0.4% | 27.74% |

| 16 | Madhya Pradesh | 0.6% | 27.88% |

| 17 | Mumbai (Due to Octroi) | 0.2% | 30.63% |

(b) That there had been no change in MRP pre and post GST (₹ 27,490/-) and the applicable GST rate of 28% was higher than the pre-GST rate.

(c) That the applicable GST rate was 28% which was higher than the pre-GST rate, thus the question of profiteering did not arise.

(d) That the computation of profiteering could not be done based on post discount prices, since in the pre-GST regime, Central Excise Duty was calculated as a percentage of a fixed MRP, but under GST regime, GST was calculated on the basis of the actual price, which was variable. Thus, in case, higher discount was given, then effective tax rate would increase as a percentage of the discounted price or in other words, if a fixed amount of tax was calculated (as a percentage) to variable price, the rate of tax would have fluctuated for every transaction, thus would lead to the distorted results. He also explained the same with the illustration in Table given below:-

Table J: Different tax rate if computed on discounted base price

(Amount in Rs.)

| Product [Elena Aqua VX] | Pittappillil Agencies | Qrs Retail Limited | Bismi Appliances | Nandilath G Mart |

| Invoice No. | 3220057999 | 3220058338 | 3220058145 | 3220058411 |

| Invoice Date | 31-05-2017 | 27-06-2017 | 12-06-2017 | 30-06-2017 |

| Base Price as per invoice (A) | 24,009 | 24,009 | 24,009 | 24,009 |

| Excise Duty [per unit considered by DGAP] 2,234 | 2,234 | 2,234 | 2,234 | |

| (B) | | | | |

| Trade Discount as per Invoices (C) | 2,881 | 3,822 | 4,562 | 4,322 |

| Net Price Charged from customer [(D)=A-B-C] | 18,894 | 17,953 | 17,213 | 17,463 |

| VAT on product [E = (A-C)*14.5%] | 2,299 | 2,927 | 2,820 | 2,855 |

| Total taxes [F=B+E] | 4,533 | 5,161 | 5,064 | 5,089 |

| Effective tax rate [G=F/D*100] | 24.0% | 28.7% | 29.4% | 29.2% |

Explaining the table above, the Respondent submitted that the tax rates applicable on product during the pre-GST regime were Excise Duty @ 12.5% on 65% of MRP and VAT @ 14.5% on Actual Selling price. He added that since the two above mentioned taxes i.e., Excise Duty and VAT were payable at two different bases, varying discounts could be offered to different dealers based on independent price negotiations and the tax rate for a product would not change in the pre-GST era on account of different prices charged to different customers. Since, DGAP had computed the tax rate based on discounted base price, there was different effective tax rate for each dealer on account of varying quantum of discounts offered to each dealer. The Respondent thus submitted that it was incumbent on the DGAP to have not calculated the tax rate on the basis of post discount prices.

(e) He reiterated that the method of comparison adopted by DGAP was incorrect since the average price in respect of pre-GST period have been only compared with the average price for post GST period. Further, he reiterated that DGAP had only considered the positive numbers (where post-GST base price was higher than the pre-GST base price) to arrive at the profiteering, which was unjustified. He also explained the same with the illustration in Table given below:-

Table K: Incorrect Profiteering computed by DGAP based on pre-GST Average Price

(Amount in Rs.)

| Name of the Dealer/ Customer | Pittappillil Agencies | QRS Retail Limited | Bismi Appliances | Nandilath G Mart |

| (1) | (2) | (3) | (4) |

| Pre-GST base price after discount (A) | 18.694 | 17,953 | 17,213 | 17,453 |

| Average Pre GST Base price (B) | 17878 |

| Post GST discounted Base price (C) | 16,690 | 17,393 | 16,536 | 16,751 |

| Average Post-GST Base price (D) | 17343 |

| Actual Reduction In Base Price: actual comparison (E)= (C- A) | -204 | -560 | -677 | -702 |

| Actual reduction in Average prices (F) = (D-B) | – 535 |

| Increase in Base price as per DGAP method (G) = (C-B) | 812 | -485 | -1342 | -1127 |

| Percentage of actual reduction in base price in Post GST | 1.09% | 3.22% | 4.09% | 4.19% |

(f) That from the above table, it was dear that different prices had been charged from different dealers both during the pre-GST and Post GST period (refer row A & C) and the prices for each dealer had actually reduced in the post GST period. He also stated that the basis of comparison by the DGAP was not same as the DGAP had determined average price for pre-GST period but had incorrectly compared average of Pre GST prices with independent prices for each dealer during the Post GST period, Further, the DGAP had ignored the transactions where post GST prices were lower than pre GST average price and had alleged profiteering for transactions where post GST price was greater than the pre GST Average price. This approach was incorrect as comparison of an average value 1 price with sales at above average values/price would always arithmetically result in a positive number even if the prices for that customer has been reduced post GST.

(g) That the non-consideration of Large number of sale invoices where post GST discounted price were lower than average of pre-GST discounted base price, in itself showed that computation of profiteering in the report was erroneous and arbitrary. He also stated that the fact that DGAP had not replied to the several computational errors highlighted by him implied that such errors had been accepted by the DGAP. He also submitted his version of the calculation of profiteering based on comparison of prices for the pre and Post GST periods at Dealer level.

(h) That the principle adopted by DGAP was actually an attempt to regulate the price and profit which was against the mandate of the provisions.

(i) He also submitted the revised calculation based on comparison of prices for pre and post GST period at dealer level.

20. The DGAP vide his Report dated 18.02.2019 on the submissions made by the Respondent on 12.02.2019, submitted that the Respondent had submitted dealer-wise data in respect of different States. However, the DGAP had conducted the investigation by working out the average of discounted base prices during the pre-GST period, separately for each State and comparing the same with the actual invoice-wise discounted base prices in the post-GST period for the same State. Only those invoices had been taken into account for computing profiteering, where the post-GST discounted base price was more than the average of pre-GST discounted base prices. The invoices where the post-GST discounted base price was less than the average of pre-GST discounted base prices had not been considered by the DGAP.

21. The Respondent filed his next written submissions on 27.02.2019. Vide his submissions; he submitted the dealer wise impact of comparison of prices for sale of product during pre-GST and post GST period i.e. from 01-07-2017 to 07-06-2018 and state wise impact of comparison of prices for sale of the product during pre-GST and post GST period i.e. from 01-07-2017 to 07-06-2018. He also submitted the summary of impact of price reduction on sale of the impugned product during pre and post GST regime with help of a table given below:-

Table L: Summary of Impact of price reduction – on sale of Elena Aqua VX during Pre and Post GST regime

(Amount in Rs.)

| State | Net Impact | Only Positive | Only Negative |

| Andhra Pradesh | -76,221 | 9,074 | -85,295 |

| Bihar | 1,943 | 5,625 | -3,682 |

| Chhattisgarh | -4,060 | 4,397 | -8,457 |

| Gujarat | -1,56,412 | 91,292 | -2,47,705 |

| Karnataka | -55,152 | 28,914 | -84,065 |

| Kerala | -8,93,765 | 1,30,057 | -10,23,823 |

| Madhya Pradesh | -2,678 | 11,438 | -14,116 |

| Rajasthan | -9,609 | – | -9,609 |

| Tamil Nadu | -5,84,633 | 42,892 | -6,27,524 |

| Uttar Pradesh | -64,245 | 12,386 | -76,631 |

| West Bengal | 12,657 | 16,831 | -4,174 |

| Jammu & Kashmir | -3,578 | – | -3,578 |

| Haryana | -725 | – | -725 |

| Punjab | -14,610 | – | -14,610 |

| Uttarakhand | -10,093 | – | -10,093 |

| Delhi | -1,54,096 | 3,864 | -1,57,960 |

| Goa | -12,09,317 | 2,390 | -12,11,707 |

| Himachal Pradesh | -7,199 | 379 | -7,577 |

| Maharashtra | -1,23,776 | 2,465 | -1,26,241 |

| North East | -3,488 | – | -3,488 |

| Orissa | -6,779 | – | -6,779 |

| Telangana | 5,713 | 14,301 | -8,588 |

| Total States | -33,60,124 | 3,76,305 | -37,36,429 |

22. In response to the above submissions of the Respondent, the DGAP, vide his Report dated 15.03.2019, reported that

(a) The Respondent had mentioned that he had increased the MRP of the product from ₹ 26,990/- to ₹ 27,490/- in the month of March, 2017 and that the period considered for working out the average discounted base price during the pre-GST period was taken only from April, 2017 to June, 2017 and that the Respondent had also submitted that the Central Excise Duty of ₹ 2,234/-(@12.5% on 65% of the MRP of ₹ 27,4904 which was considered for computation of the pre-GST base price, was in respect of the new MRP of ₹ 27,490/-. However, the product sold during the period April, 2017 to June, 2017, were carrying the MRP of both ₹ 26,990/- and ₹ 27,490/-. The DGAP also reported that the Respondent had already submitted that whereas the Central Excise Duty on the product carrying the MRP of ₹ 26,990/- was ₹ 2193/-, the DGAP had taken an uniform Central Excise Duty of ₹ 2234/- for all the transactions which was @12 5% on 65% of the higher MRP, i.e. ₹ 27,490/-. The DGAP further reported that the Respondent had also stated that they were offering different types of discounts to different dealers based on the agreement and the quantum of the product sold and submitted the dealer-wise data for different States and the aforesaid two different MRPs and that the Respondent had again increased the MRP of the product from ₹ 27,490/- to ₹ 28,490/- w.e.f. 07.06.2018 which was higher, had been taken by the DGAP. On this issue, the DGAP reported that this was a new fact which had not been previously submitted by the Respondent, at any time during the investigation.

(b) That the dealer-wise data in respect of different States could not be considered to arrive at the total applicable tax rate in the pre-GST period as there were more than 1000 dealers to whom the Respondent had made supplies in the pre-GST period as also the post-GST period and it was not possible to compare the pre-GST and post-GST base prices in respect of each dealer separately. DGAP further submitted that the investigation was conducted based on the average of the discounted base prices during the pre-GST period separately for each State which were then compared with the actual invoice-wise discounted base prices in the post-GST period for each of the States separately and that he had adopted this line of investigation uniformly for all the cases.

(c) That only those invoices had been taken into account for computing profiteering, where the post-GST discounted base prices were higher than the average pre-GST discounted base price. The invoices where the post-GST discounted base prices were lower than the average pre-GST discounted base prices had not been considered since these did not reflect profiteering. The DGAP mentioned that, the Respondent’s claim of increasing the MRP from ₹ 26,990/- to ₹ 27,490/-, in the month of March, 2017 and from ₹ 27,490/- to ₹ 28,490/- we.f. 07.06.2018 had been verified. Accordingly, the pre-GST and post-GST tax rates for different States which are furnished in table below, clearly demonstrated that there was a reduction in the net tax rate at the time of advent of GST (on 01.07.2017) in 15 out of 21 States to which supplies had been made by the Respondent:–

Table-M

(Amount in Rs.)

The DGAP also stated that in his report dated 06.12.2018, 22 States were mentioned because the Respondent had wrongly shown supplies to the State of J&K.

(d) That, on the basis of the aforesaid pre-GST and post-GST tax rates and the details of outward supplies of the impugned product to the States mentioned at S. Nos. 1 to 15 of the table above, the amount of higher sale realization due to increase in the base price of the product, despite reduction in the rate of tax post implementation of GST w.e.f. 01.07.2017, or in other words, the profiteered amount had been separately calculated for the periods 01.07,2017 to 31.08.2018 and 01.07.2017 to 06.06.2018 (in view of increase in the MRP/base price w.e.f. 07.06.2018). The DGAP in his subsequent report dated 15.03.2019 has reported that the profiteered amount for the period from 01.07,2017 to 31.08.2018 comes to ₹ 67,28,592/- whereas the profiteered amount when worked out for the period from 01.07.2017 to 06.06.2018 works out to ₹ 37,97,663/-. The said state-wise profiteered amount has been arrived at by comparing the commensurate price on the basis of State-wise pre-GST average base price of the impugned product sold during the periods of 01.04.2017 to 30.06.2017, with the actual invoice-wise cum-tax prices during the post-GST period from 01.07.2017 to 31.08.2018 and separately for the period from 01.07.2017 to 06.06,2018, for facilitating a decision thereon, as shown in the tables below:-

Table

(01.07.2017 to 31.08.2018)

| S.No. | State Code | State (Place of Supply) | Profiteering (Rs.) |

| 1 | 37 | Andhra Pradesh | 153892 |

| 2 | 10 | Bihar | 30083 |

| 3 | 22 | Chhattisgarh | 32242 |

| 4 | 24 | Gujarat | 489976 |

| 5 | 20 | Karnataka | 179221 |

| 6 | 32 | Kerala | 3459894 |

| 7 | 23 | Madhya Pradesh | 132493 |

| 8 | 18 | Assam | 2095 |

| 9 | 3 | Punjab | 19184 |

| 10 | 8 | Rajasthan | 840 |

| 11 | 33 | Tamil Nadu | 2047928 |

| 12 | 36 | Telangana | 90596 |

| 13 | 9 | Uttar Pradesh | 47015 |

| 14 | 5 | Uttarakhand | 4704 |

| 15 | 19 | West Bengal | 38429 |

| Total | 68,28,592 |

Table

01.07.2017 to 06.06.2018

| S.No. | State Code | State (Place of Supply) | Profiteering (Rs.) |

| 1 | 37 | Andhra Pradesh | 84568 |

| 2 | 10 | Bihar | 26738 |

| 3 | 22 | Chhattisgarh | 19877 |

| 4 | 24 | Gujarat | 336149 |

| 5 | 29 | Karnataka | 108166 |

| 6 | 32 | Kerala | 1754329 |

| 7 | 23 | Madhya Pradesh | 116156 |

| 8 | 18 | Assam | 1225 |

| 9 | 3 | Punjab | 15031 |

| 10 | 8 | Rajasthan | 840 |

| 11 | 33 | Tamil Nadu | 1236809 |

| 12 | 36 | Telangana | 31220 |

| 13 | 9 | Uttar Pradesh | 41065 |

| 14 | 5 | Uttarakhand | 4570 |

| 15 | 19 | West Bengal | 20901 |

| Total | 37,97,663 |

The DGAP further stated that the Authority might decide as to which period should be considered i.e. up to 31.08.2018 or 06.06.2018.

23. The Respondent filed his next written submission on 22.04.2019, vide which he stated that:-

(a) The DGAP vide his report dated 15.03.2019 had compared the tax rates applicable during period prior to and post introduction of GST which was beyond the ambit of Section 171 of the CGST Act, 2017, since the section 171 of CGST Act, did not deal with comparison of any change in the tax rate in post-GST regime with tax rates applicable during pre-GST regime. He further submitted that the above Section contained no reference to tax rate under provisions of erstwhile tax laws i.e., central excise and VAT. In fact, provisions of the erstwhile laws had been repealed by virtue of Sec. 174 of CGST Act.

(b) Without prejudice to his submissions dated 27.02.2019, the DGAP had completely overlooked the directions of the Authority to review the dealer wise pre and post GST price and tax rate analysis submitted by IFB. Instead of reviewing the working submitted by the Respondent, the DGAP had only provided the justification that it was not possible to compare the details submitted by the Respondent as there were more than 1000 dealers to whom the sales had been made. The DGAP had also recomputed the profiteering impact considering the invoice-wise cum-tax prices, i.e. total invoice price including taxes – which was clearly not the direction given by the Authority.

(c) The DGAP had inter-alia failed to understand his submissions during the entire course of proceedings based on which the revised comparison for pre and post GST prices collected from each dealer was submitted exhibiting the effective tax rate (for each dealer) during pre GST and post GST period along with the impact of increased prices if any, collected from each dealer post GST. The Respondent further submitted that the stand point of the DGAP that the dealer wise statement submitted by him could not be considered as there are more than 1000 dealers to whom the Respondent have made supplies was unjustified. He further submitted the statement of price and tax charged from each dealer (customer) during the pre and post GST period.

24. In response, the DGAP vide his submissions dated 03.05.2019 and 11.06.2019 reported that all the issues raised by the Respondent in his submissions dated 22.04.2019 had already been discussed and stood clarified in his previous report dated 15.03.2019 submitted to the Authority.

25. The Respondent vide email dated 22.06.2019 filed his next written submission, wherein he cited the judgements of Hon’ble Supreme Court in the cases of:-

(i) Consumer Online Foundation and Others vs. Union of India and Others, (2011) which stated that

“It is a settled principle of statutory interpretation that any compulsory exaction of money by the Government such as a tax or a cess has to be strictly in accordance with law and for these reasons a taxing statute has to be strictly construed.

AS observed by this court in Ahmadabad Urban Development vs. Sharad kumar Joyanti kumar Pasawalla, (1992) 3 SCC 285, it has been consistently held by this court that whenever there is compulsory exaction of money, there should be specific provision for the same and there is no room for intendment and nothing is to be read or nothing is to be implied and one should look fairly to the language used.”

(ii) CCE (Import), Mumbai vs. Dillip Kumar and Company and Ors, MANU/SC/0789/2018 which stated that

“After thoroughly examining the various precedents some of which were cited before us and after giving our anxious consideration, we would be more than justified to conclude and also compelled to hold that every taxing statute including, charging, computation and exemption Clause (at the threshold stage) should be interpreted strictly. Further, in case of ambiguity in a changing provision, the benefit must necessarily go in favour of subject/assessee.

In the governance of Rule of low by a written constitution, there is no implied power of taxation. The tax power must be specifically conferred and it should be strictly in accordance with the power so endowed by the constitution itself. It is for this reason that the Courts insist upon strict compliance before a State demands and extracts money from its citizen towards various taxes. Any ambiguity in a taxation provision, therefore, is interpreted in favour of the subject/assessee. The statement of law that ambiguity in a taxation statute should be interpreted strictly and in the event of ambiguity the benefit should go to the subject Assessee may warrant visualising different situations. For instance, if there is ambiguity in the subject of tax, that is to say, who are the persons or things liable to pay tax and whether the revenue has established conditions before raising and justifying a demand. Similar is the case in roping all persons within the tax net, in which event the State is to prove the liability of the persons, as may arise within the strict language of the law. There cannot be any implied concept either in identifying the subject of the fox or person of the liable to pay tax. That is why it is often said that subject is not be taxed, unless the words of the statue unambiguously impose tax on him, that one has to look merely at the words clearly stated and that there is no room for any intendment nor presumption as to tax. It is only the letter of the law and not the spirit of the law to guide the interpreter to decide the liability to tax ignoring any amount of hardship and eschewing equity in taxation. Thus, we may emphatically reiterate that if in the event of ambiguity in taxation liability statute, the benefit should go to the subject/Assessee.”

The Respondent also stated that the prices charged by him from his dealers post introduction of GST had actually reduced and the net impact of such price change was negative i.e., (-) ₹ 33,60,124/-. In few cases, difference of base price was positive to the extent of ₹ 3,76,305/-, primarily due to reduction in discounts offered, sales of certain old MRP inventory in pre-GST period to such dealers, which needed to be ignored since the same was not due to change in tax rate but due to business marketing reasons. He also submitted that the Analysis carried out by DGAP at discounted prices was against the principles laid down by the Authority, particularly because pre-GST tax rates were based on MRP and in GST, it was ad valorem. The Respondent further submitted that the proceedings in the present matter were barred by limitation prescribed under Rule 133(1) of the COST Rules, 2017, in terms of the response by the DGAP dated 11.06,2019 since proceedings were required to be completed within a period of 3 months from the date of receipt of report from DGAP and in the present case, the DGAP’s report under Rule 129 (6) was submitted to the Authority on 0612.2018. Thus, time limit as prescribed under Rule /33(1) had already lapsed and the present proceedings were time barred.

26. The DGAP vide his submissions dated 09,07.2019 had stated that all the issues raised by the Respondent had already been discussed in his previous report dated 06.12,2018 and 15.03.2019 submitted to the Authority.

27. We have carefully considered the material placed before us and all submissions made by the Respondent and by the DGAP. The issues to be decided by the Authority are as under-

1) Whether there was any violation of the provisions of Section 171 of the CGST Act, 2017 in this case?

2) If yes then what was the quantum of profiteering?

28. Perusal of Section 171 of the COST Act shows that it provides as under:-

(1). “Any reduction in rate of tax on any supply of goods or services or the benefit of input tax credit shall be passed on to the recipient by way of commensurate reduction in prices”

In the instant case, the Respondent has raised certain objections first of which is that the average price was considered for pre-GST period, but for the post-GST period, the actual price from the invoices was taken which is incorrect and the average prices for post GST period should also have been taken for the computation of profiteering amount, This objection is also incorrect since it is impossible to compare the actual pre-GST invoices with the actual post-GST invoices state-wise and dealer-wise. It was also not feasible to check the availability of the pre-GST invoices of the same dealer for same state with the post-GST invoices of the same dealer for the same SKU for same state. Thus, the basis adopted by the DGAP is correct. Further, the Authority is of the view that Section 171 of the CGST Act, 2017, puts the onus of passage of any benefit of the GST rate reductions or ITC to the recipient on the supplier. The keyword to be emphasised here is “commensurate reduction”. The law expects that commensurate reduction to the extent of the rate reductions should be given by the Respondent. Any greater reduction in prices is entirely a business call taken by the Respondent well within his right and hence there is no ground to compensate him on this ground. The Respondent, while claiming this contention, has also claimed that the amount of profiteering was to be calculated entity-wise. However, this is not the correct interpretation of the law. The amount of profiteering has to be calculated by keeping the recipient at the centre. This implies that one particular recipient may have bought one product from the Respondent at a price which he was entitled to pay when the rates of tax were reduced but simultaneously there is another recipient who has paid more than what he was supposed to pay for some another product of the Respondent. The additional benefit given to one recipient cannot be offset with the denial of benefit to another recipient, as this is not the spirit of the law. Since, the Respondent’s interpretation of Section 171 of CGST Act, 2017, doesn’t have any legal merit, it cannot be accepted.

29. The Respondent has also claimed that the prices charged by him from his dealers post introduction of GST had actually reduced and the net impact of such price change was negative and while comparing the average price for pre-GST period with sales transactions in post GST regime, sales made in GST period at price lower than pre-GST average price had been ignored, But this contention is not correct since aggregate profiteering has to be computed on the basis of what each consumer has lost due to non-reduction of the prices in a commensurate manner by the Respondent.

30. The Respondent has referred Kerala State Screening Committee and another Vs. M/s. Asian Paints Ltd. [Case No. 29/2018 decided on 27.12.2018], Kerala State Screening Committee and another Vs. M/s Peps Industries Pvt. Ltd [Case No. 22/2018 decided on 27.09.2018] and Kerala State Screening Committee and another Vs. M/s. Maruti Suzuki India Ltd. [Case No. 01/2019 decided on 02.01.2019] are of no help to the Respondent since no fixed mathematical methodology can be determined for all the cases of profiteering as the facts of each case differ. Therefore, the determination of the profiteered amount has to be computed by taking into account the particular facts of each case, Hence, it is respectfully submitted that the cases referred to by the Respondent are of no help to him.

31. The Respondent has also cited the judgement passed in the case of Indraprastha Gas Ltd. v. Petroleum and Natural Gas Regulatory Board and othe₹ 2015 (9) SCC 209 in his support. However, in this case the issue involved was fixing of the maximum retail price of the gas on which it could be sold, however in the present case no such direction has been sought to be passed by the DGAP through his present Reports and hence the argument advanced by the Respondent on the basis of the above judgement cannot be accepted.

32. The Respondent had also cited the decision of Hon’ble Apex court in the cases of Kunj Behari Lal & Ors. v. State of H.P., 2000 (3) SCC 40, in his support but it also do not come to the rescue of the Respondent since the present proceedings and the computation are strictly in accordance with the provisions of Section 171 (1) & (2) of the CGST Act, 2017 and facts of these cases are at variance with the instant case. We also observe that the provisions of Section 171 of the CGST Act, 2017 are aimed at ensuring that the recipient gets the commensurate benefit, in the form of reduction of price, in case of any tax rate reduction and/or incremental benefit of ITC (i.e. a sacrifice made by the Govt. from its tax kitty) and the method of interpretation of this provision is given in the text of Section 171 of the CGST Act, 2017 itself. We observe that the said provision clearly links profiteering to be a function of each supply of goods or services or both and hence, profiteering needs to be computed at the level of each invoice and not at the entity level or any consolidated level. From a complete reading of Section 171 of the Act ibid, it is amply clear that the total quantum of profiteering by an entity/registrant is the sum total of all the benefits that stood denied to each of the recipients/consumers individually. The intent of the words “commensurate reduction” is also clearly explained by the words “by reduction in price”.

33. The Respondent has also placed reliance on the judgement of the Hon’ble Supreme Court passed in the case of Commissioner Central Excise and Customs Kerala v. Larsen and Toubro Limited (2016) 1 SCC 170. However, it is respectfully submitted that in the above case the issue involved was pertaining to the lack of machinery for enforcing the levy of Service Tax however, in the present case no tax has been levied and hence the law settled in the above case does not apply.

34. The Respondent further cited the judgements of the Hon’ble Supreme Court in the cases of Consumer Online Foundation and Others vs Union of India and Others, (2011), CCE (Import), Mumbai vs Dillip Kumar and Company and Ors, CIT vs B. C. Srinivasa Shetty [(1991) 2 SCC 460] in his support which pertain to the interpretation of the statutes. It is to emphasize that the legal principles for interpreting a statute are to be used only when parent legislation is ambiguous and unclear in its intent. In the instant case, Section 171 of the CGST Act, 2017, is crystal clear in its objective and scope and it is on different footing when compared to all other sections of the CGST Act, 2017 and hitherto prevalent taxation laws of the land in as much as it provides for a mechanism to ensure that consumers derive the benefit of any reduction in tax or increased availability of ITC, which is ultimately a sacrifice made by the Govt. from its revenue. Hence, it is respectfully submitted that the cases referred to by the Respondent No 1 are of no help to him.

35. We also find that the Respondent has further averred that the MRP for the product was not increased by him even when rate of tax, post introduction of GST, Le. in July 2017, had been increased from 26,40% to 28% and hence he should be allowed to offset this loss when the tax rate was later reduced, This averment of the Respondent is also untenable since the rate of tax was not increased as the Respondent had claimed i.e. from 26.40% to 28% in July 2017, instead there was a reduction in the rate of tax in respect of 15 out of 21 States w.e.f. 01.07.2017 as mentioned in the table K of this order.

36. Regarding another submission of the respondent that independent change in price in each and every case/ sale transaction was not always due to tax factor and was not relevant for analysing overall impact of GST on a product and each change in the negotiated price cannot be considered as profit arising due to GST. In this regard, profiteering has to be seen from the prism of the consumer and if he had to pay more than the commensurately reduced price, it amounts to profiteering. In fact, even if the tax has been paid in excess of the correctly leviable amount by the Respondent, the consumer has been deprived of the benefit of commensurate reduction in price, hence such an element of tax has been correctly included in the calculation of the profiteered amount. Hence, we uphold the DGAP’s computation of the profiteered amount as apt and correct. This contention of the Respondent is liable to be rejected as it holds no ground.

37. Another contention of the Respondent is that the computation of profiteering should have been on the basis of prices charged at a pan India level and not based on prices charged in specific states and specific transactions. This contention of the Respondent is also incorrect since profiteering is computed by the DAP only in respect of the States where the rate of tax was increased from pre-GST to post-GST, thus the DGAP has rightly computed the profiteering. The Respondent further queried that since the instant enquiry was meant only for the State of Kerala and hence, the inclusion of certain other States in the study and exclusion of some others was unjustified. In our opinion, this contention of the Respondent does not hold good since Section 171(1) and (2) of the CGST Act state as follows:-

“(1) Any reduction in rate of tax on any supply of goods or services or the benefit of input tax credit shall be passed on to the recipient by way of commensurate reduction in prices.

(2) The Central Government may, on recommendations of the Council, by notification, constitute an Authority, or empower an existing Authority constituted under any law for the time being in farce, to examine whether input tax credits availed by any registered person or the reduction in the tax rate have actually resulted in a commensurate reduction in the price of the goods or services or both supplied by him.”

Nowhere, it mentions that the investigation should be done only for the State of complaint filed and not for other states, The Authority is therefore of the view that all the supplies made have to be taken into account.

38. The Respondent further objected that no methodology and procedure for determining the anti-profiteering amount had been prescribed by Legislature and the provisions of Section 171 of the CGST, Act and Rule 122 to 137, being part of a taxing Statute cannot be enforced in the absence of machinery provisions for computation of the profiteered amount. He also objected that no mechanism/ guideline had been prescribed as to whether the price alteration was required to be done at entity level, State level, product level, SKU level, category level and there was no guidance whether commensurate change in price would be assessed in absolute terms or as trend or in percentage terms. On these issues, it is stated that Section 171 (1) of the CGST Act, 2017 clearly states that “Any reduction in the rate of tax on any supply of goods or services or the benefit of input tax credit shall be passed on to the recipient by way of commensurate reduction in price”. Therefore, the intention of the legislature is amply clear from the above provision which requires that the benefit of tax reduction or ITC is required to be passed on to the customers by commensurate reduction in prices. This Authority has been duly constituted under Section 171 (2) of the above Act and in exercise of the powers conferred on it under Rule 126 of the CGST Rules, 2017 has notified the ‘Procedure & Methodology’ for determination of the profiteered amount vide its Notification dated 28.03.2018. However, the mathematical methodology for determination of the profiteered amount has to be applied on case to case basis depending on the facts of each case and no fixed formula can be set for calculating the same as the facts of each case are different. It would also be appropriate to mention here that this Authority has power to ‘determine’ the methodology and not to ‘prescribe’ it as per the provisions of the above Rule and therefore, no set prescription can be laid while computing profiteering, It would be further relevant to mention that the power under Rule 126 has been granted to this Authority by the Central Govt., as per the provisions of Section 164 of the above Act which has approval of the Parliament. Rule 126 has further been framed on the recommendation of the GST Council which is a constitutional body created under the Constitution (One Hundred and First Amendment) Act, 2016, Therefore, the above power has both legislative sanction as well as incorporation in the CGST Act, 2017 and the CGST Rules, 2017. The delegation provided to this Authority under the above Rule is clear, precise, unambiguous and necessary and is well within the provisions of the Constitution and therefore, it has been rightly conferred on this Authority. Hence, the objections raised by the Respondent in this regard are frivolous and without legal force.

39. The Respondent also contended that there were no provisions in the Act for penal action as provided in the Rule 133 and there can be no invocation of the penal provisions in the present case. It is incorrect since the power of imposition of penalty is duty assigned by the CGST Act, 2017 and Rule 127 (iii) (c) and Rule 133 (3) (d) of the CGST Rules, 2017 to the Authority.

40. The Respondent has also contended that the calculation of DGAP is based on discounted base price and since discounts were reduced, there emerged so called profiteering. The Respondent further stated that the tax rates applicable on product during the pre-GST regime were Excise Duty @ 12.5% on 65% of MRP and VAT a 14.5% on Actual Selling price and since the two above mentioned taxes i.e., Excise Duty and VAT were payable at two different bases, varying discounts could be offered to different dealers based on independent price negotiations and the tax rate for a product would not change in the pre-GST era on account of different prices charged to different customers, With regard to the above contentions it would be relevant to refer Section (15) (1) of the CGST Act, 2017 which reads as under:-

“The value of a supply of goods or services or both shall be the transaction value, which is the price actually paid or payable for the said supply of goods or services or both where the supplier and the recipient of the supply are not related and the price is the sole consideration for the supply.”

We therefore observe that Section 15 (3) (a) provides that the value of the supply shall not include any discount which is given before or at the time of the supply, even if such discount has been duly recorded in the invoice issued in respect of such supply. Thus, GST is chargeable on actual transaction value after excluding any discount (conditional as well as unconditional) and therefore, for the purpose of computation of profiteering actual transaction value has to be considered for computation of profiteering amount. Thus, the price charged from customers is the base price which has been taken by the DGAP to arrive at the profiteering. The Respondent has mixed up two separate things, i.e. discounts and taxes, which is incorrect and not logical.

41. The Respondent has also claimed that the effective tax rate pre-GST was lower than GST rate in practically all the States and he further furnished the table giving the details of the pre-discounted tax rates of the product in pre-GST period (aggregate of ED, VAT, Entry Tax, Local Levies etc) to prove that the post-GST tax rate was more than the pre-GST tax rates. But this contention of the Respondent is not correct since the table K was prepared by the DGAP based on the contentions of the Respondent himself and the details of effective pre-GST tax rates (detailed in table I). The table K also supersedes the table C which was originally relied by the DGAP. We find that the table K is an elaborate computation of the effective state wise tax rates and the reduction in the rate of tax state wise. Hence, the table K submitted by the DGAP is correct.

42. Another contention of the Respondent is that the proceeding was barred by limitation prescribed under Rule 133(1) of the CGST Rules, 2017 since proceedings were required to be completed within a period of 3 months from the date of receipt of report from DGAP i.e. from 06.12.2018. But this contention is not correct since the DGAP had submitted his last Report on 11.06.2019 and vide Notification No. 31/2019-Central Tax dated 28.06.2019 of the Central Board of Indirect Taxes and Customs the time period for the Authority to pass the order from the date of the report of DGAP was increased to 6 months as amendment in Rule 133(1) thus, taking the 11.06.2019 as date of receipt of report from the DGAP, the time limit of 6 months has still not been completed.

43. Further, the DGAP’s vide his report dated 15.03.2019 had also clarified that the Respondent vide his submissions dated 27,02.2019 had mentioned that he had increased the MRP of the product from ₹ 26,990/- to ₹ 27,490/- in the month of March, 2017. However, the product sold during the period April, 2017 to June, 2017, was carrying the MRP of both ₹ 26,9901- and ₹ 27,490/-. The DGAP further reported that the Respondent had also stated that he had again increased the MRP of the product from ₹ 27,490/- to ₹ 28,4901- w.e.f. 07.06.2018 which was a new fact for the DGAP which had not been previously submitted by the Respondent, at any time during the investigation carried by the DGAP. Thus, the DGAP recalculated the profiteered amount for the period 01.07.2017 to 31.08.2018 which came out to be ₹ 67,28,592/- and for period 01.07.2017 to 06.06.2018 (in view of increase in the MRP/base price w.e.f. 07.06.2018) which came out to be Rs, 37,97,663/-. Since, the Respondent had himself agreed that he had again increased the MRP of the product from ₹ 27,490/- to ₹ 28,490/- w.e.f 07.06.2018, thus it can be inferred that the Respondent had not reduced the MRP of the product at any stage within the period of investigation as covered by the DGAP. Thus, the profiteered amount of ₹ 67, 28,592/- calculated by the DGAP can be relied upon, The DGAP also stated that in his report dated 06.12.2018, profiteering was computed on the 22 States which included J&K also, but since the Respondent had wrongly shown supplies to the State of J&K, thus, J&K was not considered for calculating the profiteered amount in the DGAP’s report dated 15.03,2019.

44. Based on the above facts, it is established that the Respondent has acted in contravention of the provisions of Section 171 of the CGST Act, 2017 and has not passed on the benefit of reduction in the rate of tax to his recipients by commensurate reduction in the prices. Accordingly, the amount of profiteering is determined as ₹ 67,28,592/- as per the provisions of Rule 133 (1) of the CGST Rules, 2017. The Respondent is therefore directed to reduce the prices of his products as per the provisions of Rule 133 (3) (a) of the CGST Rules, 2017, keeping in view the reduction in the rate of tax so that the benefit is passed on to the recipients, The Respondent is also directed to deposit the profiteered amount of Rs, 67, 28,592/- along with the interest to be calculated @ 18% from the date when the above amount was collected by him from the recipients till the above amount is deposited in terms of the Rule 133 (3) (b) of the CGST Rules, 2017. Since, rest of the recipients in this case are not identifiable, the above Respondent is directed to deposit the amount of profiteering of ₹ 67, 28,592/- along with interest in the Consumer Welfare Fund of the Central and the concerned State Governments as per the provisions of Rule 133 (3) (c) of the CGST Rules, 2017 in the ratio of 50:50 in the Central and State CWFs along with interest @ 18% till the same is deposited. Accordingly, an amount of ₹ 33,64,296/- will be deposited in the Central Consumer Fund while the balance will be deposited in the State CWFs as shown in the table given below:-

| S.No. | State Code | State (Place of Supply) | Total Profiteering (Rs.) |

| 1. | 37 | Andhra Pradesh New | 76946 |

| 2. | 10 | Bihar | 15041.50 |

| 3. | 22 | Chhattisgarh | 16121 |

| 4. | 24 | Gujarat | 244988 |

| 5. | 29 | Karnataka | 89610.50 |

| 6. | 32 | Kerala | 1729947 |

| 7. | 23 | Madhya Pradesh | 66246.50 |

| 8. | 18 | Assam | 1047.50 |

| 9. | 3 | Punjab | 9592 |

| 10. | 8 | Rajasthan | 420 |

| 11. | 33 | Tamil Nadu | 1023964 |

| 12. | 36 | Telangana | 45298 |

| 13. | 9 | Uttar Pradesh | 23507.50 |

| 14. | 5 | Uttarakhand | 2352 |

| 15. | 19 | West Bengal | 19214.50 |

| Total | 33,64,296 |

45. The above amount shall be deposited within a period of 3 months by the Respondent, from the date of receipt of this order, failing which the same shall be recovered by the concerned Commissioners of the Central and the State GST, as per the provisions of the CGST/SGST Acts, 2017 under the supervision of the DGAP and shall be deposited as has been directed vide this order. A detailed Report shall also be filed by the concerned Commissioners of the Central and the State GST indicating the action taken by them within a period of 4 months from the date of this order.

46. Since, the present investigation is to the issue of not passing on the benefit of reduction in the rate of tax by the Respondent has been conducted w.e.f. 01.07.2017 to 31.08.2018, the Authority, as per the Rule 133 (5) (a) of the CGST Rules, 2017, which is reproduced below, directs the DGAP to investigate quantum of profiteering on all the products including the present product which the Respondent is supplying for violation of the provisions of Section 171 of the CGST Act, 2017 and submit his Report as per the provisions of Rule 133 (5) (b) of the CGST Rules, 2017. Rule 133 (5) (a) & Rule 133 (5) (b) of the CGST Rules, 2017 is reproduced as below:-

[(5) (a) Notwithstanding anything contained in sub-rule (4), where upon receipt of the report of the Director General of Anti-profiteering referred to in sub-rule (6) of rule 129, the Authority has reasons to believe that there has been contravention of the provisions of section 171 in respect of goods or services or both other than those covered in the said report, it may, for reasons to be recorded in writing, within the time limit specified in sub-rule (1), direct the Director General of Anti-profiteering to cause investigation or inquiry with regard to such other goods or services or both, in accordance with the provisions of the Act and these rules.

(b) The investigation or enquiry under clause (a) shall be deemed to be a new investigation or enquiry and all the provisions of rule 129 shall mutatis mutandis apply to such investigation or enquiry]

47. It is also evident from the above narration of the facts that the Respondent has denied the benefit rate reduction of the GST to the consumers in contravention of the provisions of Section 171 (1) of the CGST Act, 2017 and has thus resorted to profiteering. Hence, he has committed an offence under Section 171 (3A) of the CGST Act, 2017 and therefore, he is apparently liable for imposition of penalty under the provisions of the above Section. Accordingly, a Show Cause Notice be issued to him directing him to explain why the penalty prescribed under Section 171 (3A) of the above Act read with Rule 133 (3) (d) of the CGST Rules, 2017 should not be imposed on him. Accordingly, the notice dated 13.12.2018 vide which the Respondent was directed to show cause why action under Section 29 and 122-127 of the CGST Act. 2017 should not be taken against him is hereby withdrawn.