ORDER M/s. RISEOM SOLUTIONS PRIVATE LIMITED (hereinafter referred to as the Applicant) are a manufacturer of study material kit for children containing children’s picture book is located in the Indore district of the state of Madhya Pradesh (452010). The Applicant is having a GST registration with GSTIN23AAHCR6900N1Z6.

2. The provisions of the CGST Act and MPGST Act are identical, except for certain provisions. Therefore, unless a specific mention of the dissimilar provision is made, a reference to the CGST Act would also mean a reference to the same provision under the MPGST Act. Further, henceforth, for the purposes of this Advance Ruling, a reference to such a similar provision under the CGST or MP GST Act would be mentioned as being under the GST Act.

3. BRIEF FACTS OF THE CASE –

3.1. Riseom Solutions Private Limited manufactures (print) learning kit box whom they call “Class Monitor Home Learning Kit”. The so called learning kit is manufactured, marketed and sold by the applicant only and it is not on the basis of any specific order of anyone. Such learning kit are not customizable for any person.

3.2. Children’s picture book in which pictures from principle interest for imparting education and learning to children in their early age group, divided in various age categories of 1-2.5yrs, 2.5-3.5yrs, 3.5 to 4.5 yrs, 4.5-5.5 yrs, & 6 to 8 yrs.

4. QUESTION RAISED BEFORE THE AUTHORITY –

4.1. What would be the GST rate on “Class Monitor Home Learning Kit-. will it be covered under HSN code 4903 “Children’s picture. drawing or colouring books” the GST rate on under which is NIL IGST/CGST/SGST?

5. DEPARTMENT’SVIEW POINT-Assistant Commissioner, CGST&C.Ex. Div VI Indore, the jurisdictional authority after detailed discussion has opined that the commodity for which rate of Tax has been asked attract at present 5% of GST (2.5% CGST and 2.5% SGST).

6. RECORD OF PERSONAL HEARING –

6.1 CA Shree Satayanarayan Goyal Chartered Accountant and the jurisdictional officer (SGST) appeared for personal hearing through virtual hearing. Mr. Goyal reiterated the submissions already made in the application, and attached additional submissions as follows:

6.2. That, M/s Riseom Solutions Pvt Ltd, an entity registered under GST having GSTIN23AAHCR6900N1Z6 is a manufacturer supplier of learning kitbox/book for imparting education to children.

6.3. That, such kitbox/books are educational home learning kitbox/hook for pre-schoolers aimed to develop various child’s skills such as linguistic, logical, sensory & motor, cognitive, creativity, and various other skills. The kitbox/hook contains various sheet for imparting pre-primary education and developing skills of children.

- That, the kitbox/book in itself is a complete course, made in such a manner so as to inculcate skills in child along with keeping the child interested in learning by adopting activity-based teaching methodology. The cards, pamphlets and sheets are used to educate the child by using technique of random recognition.

- That, the main content of the kitbox/book is the images and pictures, which forms the principal interest in imparting skills to children.

- That, the contents of the kithox/book are in the form of separate sheets which are grouped together in accordance to the subtopic. All the sheets are a part of a kitbox/book which are designed and is suitable for binding. However, if we bind all the sheets together to make it a binding book, the utility of such item will get affected. The users of such kitbox/book are children, who inspite of being guided by their parents to perform various activities, won’t be able to use this kitbox/book when it is bound. The contents of the kitbox/book are in the form of separate sheets (topic wise) so as to make it easy to carry/easy to handle when a child has to be taught a specific subject topic.

- That, if these separate sheets are bound together (though they can easily be bounded), it would become very heavy for a kid to use it and to learn. do clop skills and to do the activities so mentioned. Further, the box solves the purpose to keep all the contents of the course compiled together.

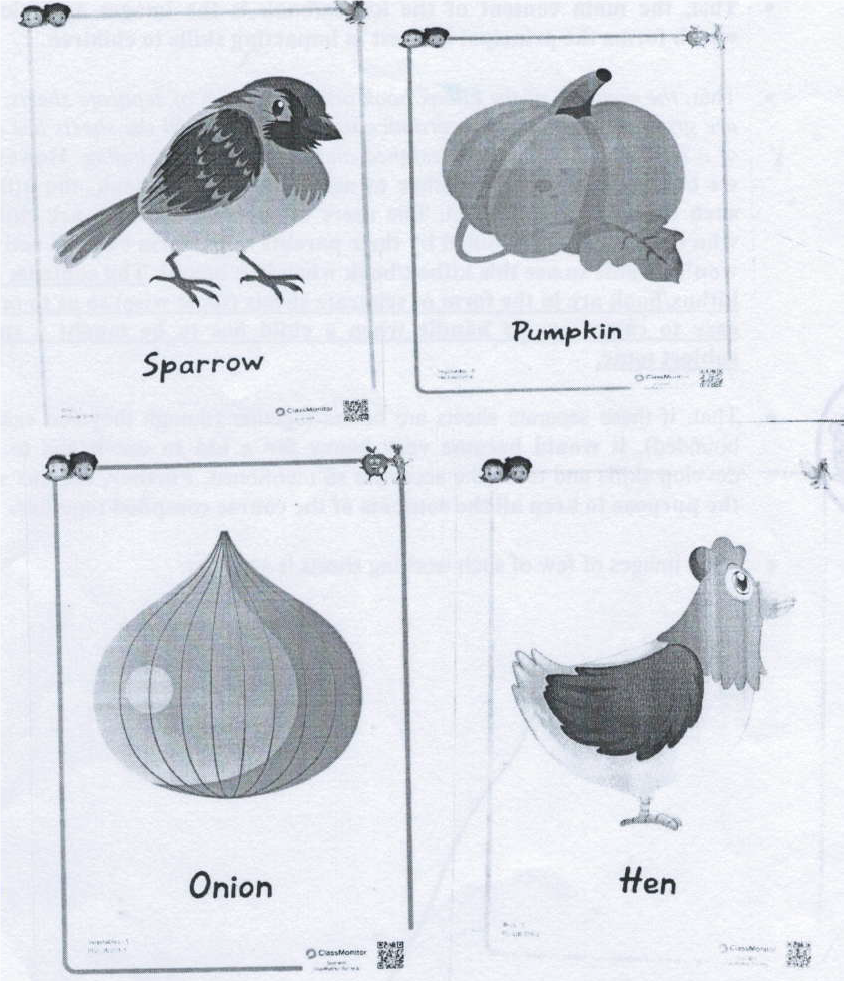

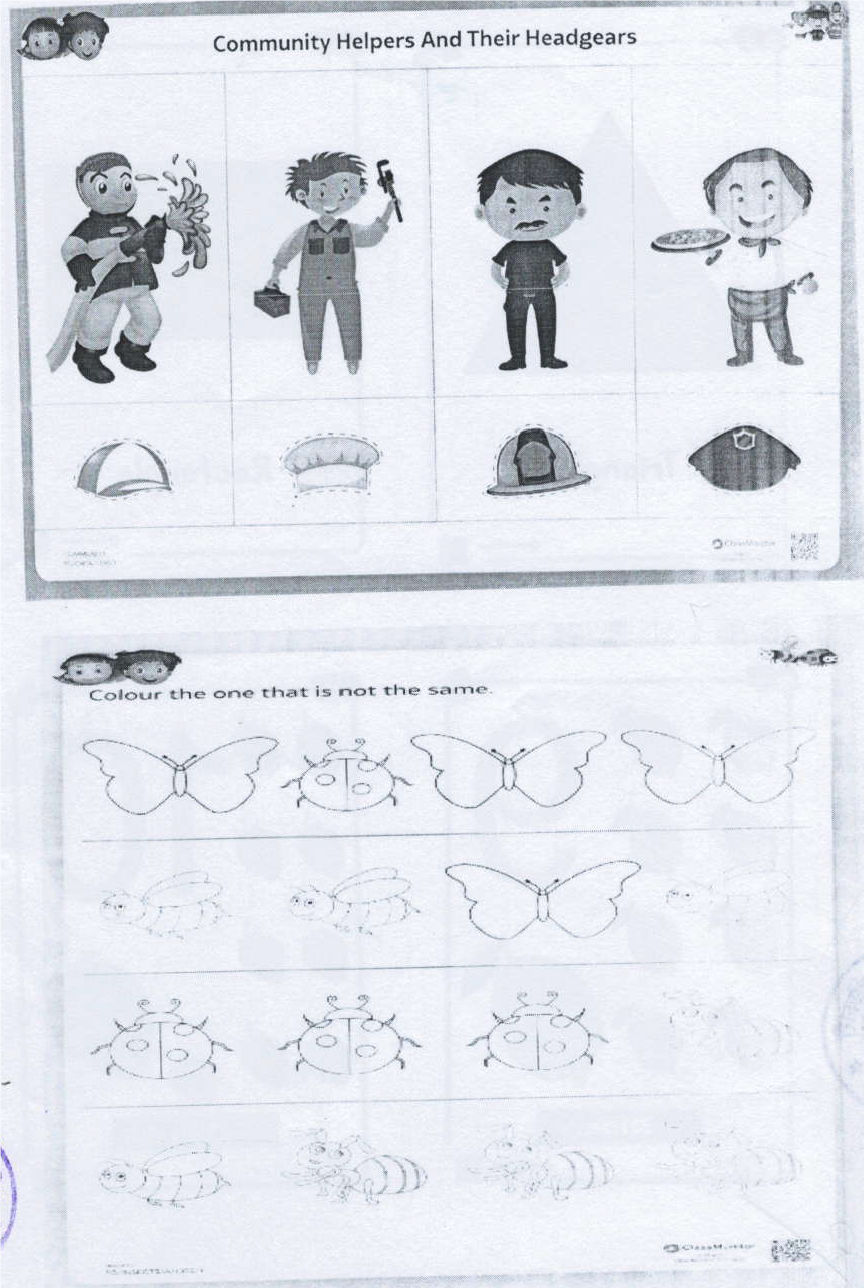

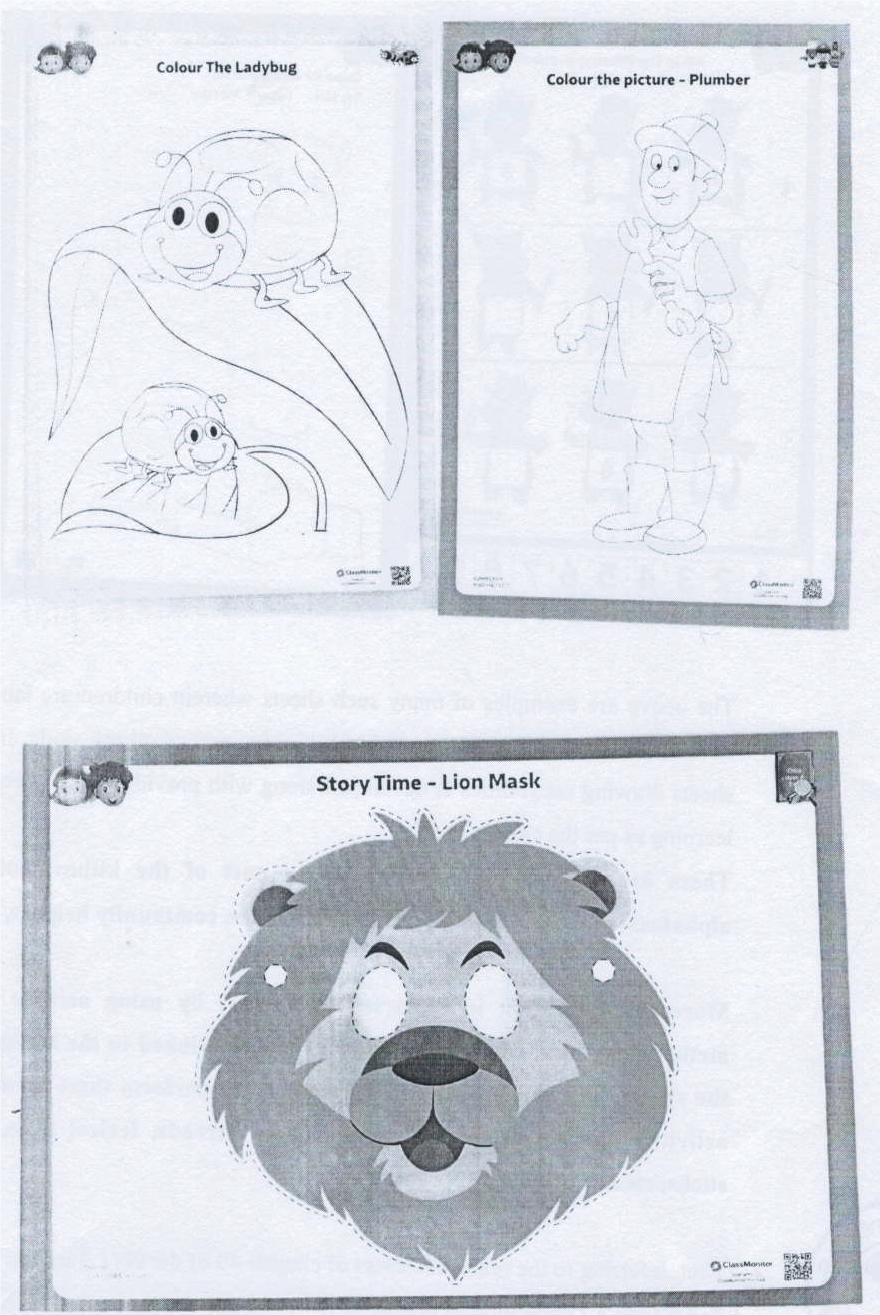

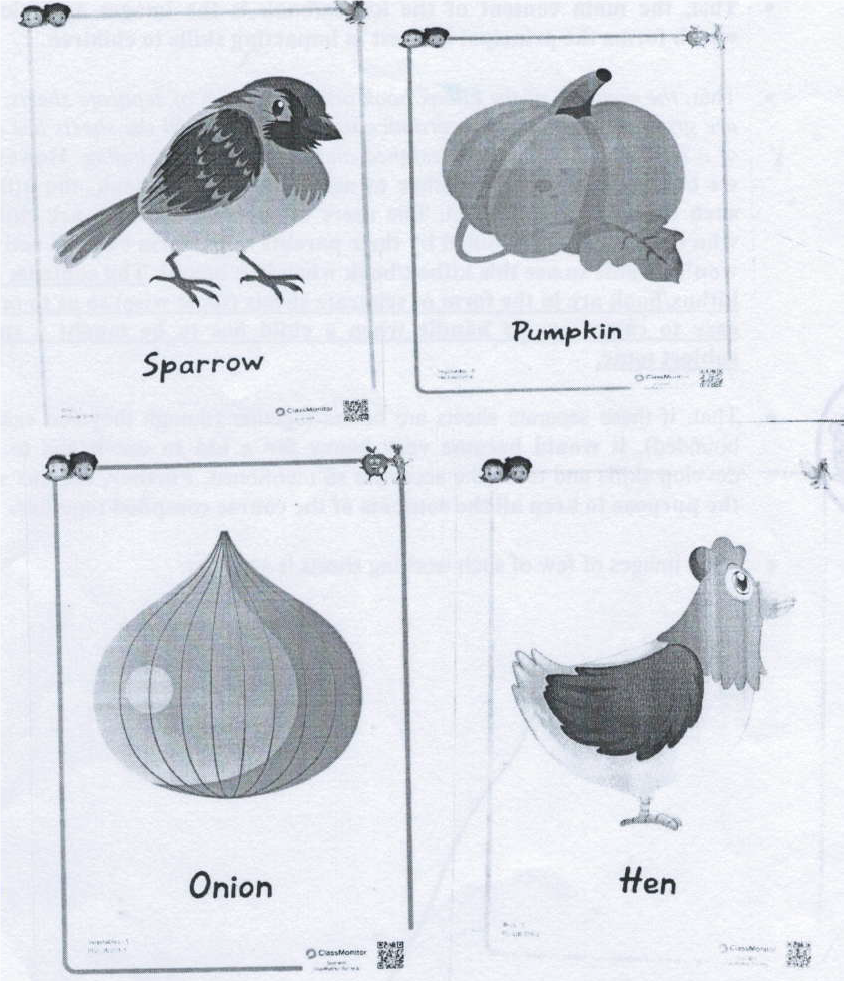

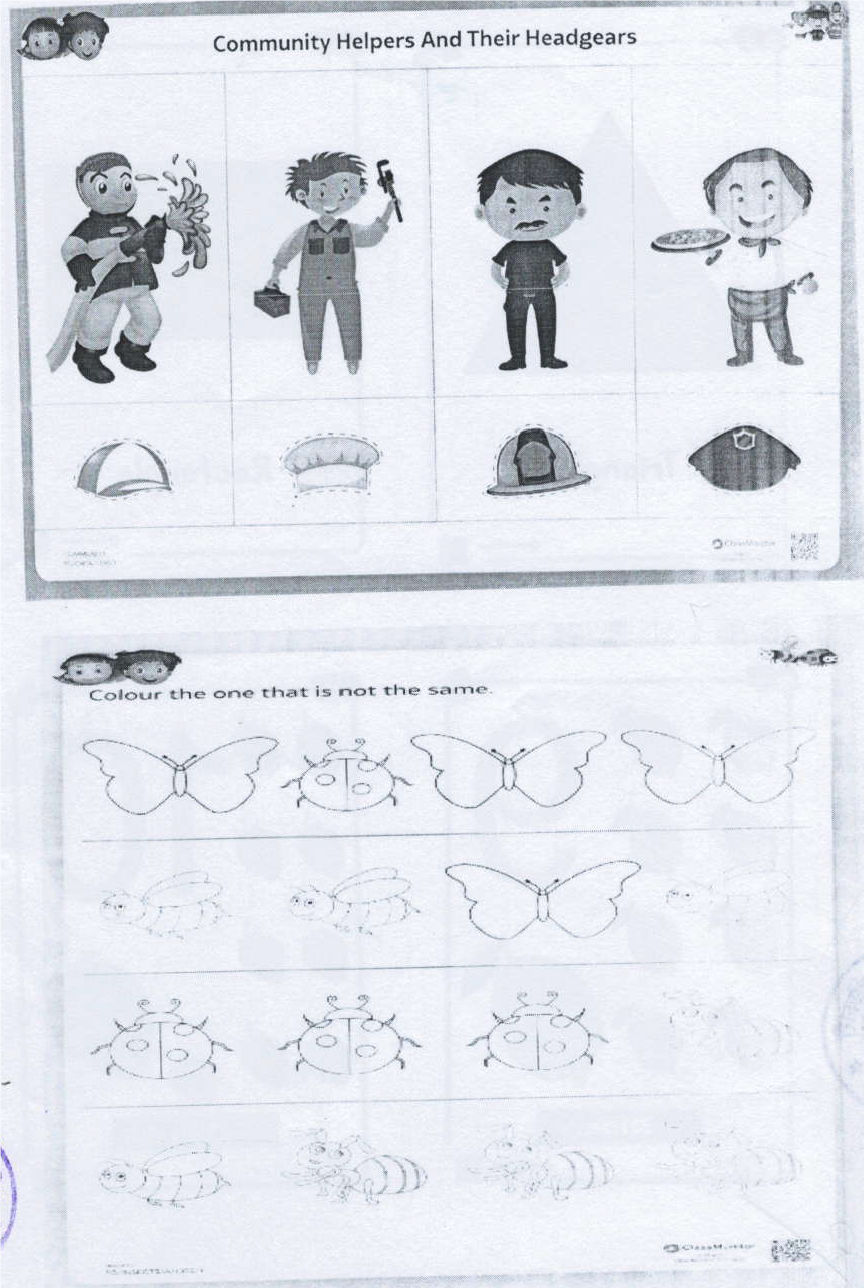

- That, images of few of such working sheets is as under:

The above are examples of many such sheets wherein children are taught to develop their various reasoning, logical thinking and creativity skills. In such sheets drawing capabilities is developed along with providing them necessary learning as per the child’s age.

There are various topics which are a part of the kitbox/book like alphabets, numbers, animals, fruits, vegetables, community helpers, etc.

Moreover, education in imparted to a child by using activity based methodology also, wherein instructions are mentioned in the backside of the sheets, and various supporting material to perform these mentioned activities like a craft paper, clips, ribbon, threads, fevicol tube, small sticks, etc are provided therein.

- That, referring to the relevant extract of chapter 49 of the GST Tariff as under:

| Tariff Item | Description of goods Unit | CGST | SGST/UTGST | lGST | |

| 4903 | Children’s picture, drawing or colouring books |

| 4903 00 | Children’s picture, drawing or colouring books: |

| 4903 00 10 | Picture Books | Kg. | NIL | NIL | NIL |

| 4903 00 20 | Drawing or colouring books | Kg. | NIL | NIL | NIL |

And also referring to point no. 6 of Notes of chapter 49, which is reproduced as below

“For the purposes of heading 4903, the expression “children’s picture hooks” means books for children in which the pictures form the principal interest and the text is subsidiary.”

On combined reading of aforementioned extract of GST Tariff, the kitbox/book should be covered under heading 4903 bearing NIL rate of tax, being the kitbox/book is a children’s picture books/ drawing or colouring book wherein the pictures form the principal interest and the text is subsidiary.

- Further, referring to HSN 4901, the relevant extract of GST Tariff of which is as under:

| Tariff Item | Description of goods | Unit | CGST | SGST/UTGST | IGST |

| 4901 | Printed books, brochures, leaflets and similar printed matter, whether or not in single sheets |

| 4901 10 | In single sheets, whether or not folded: |

| 4901 10 10 | Printed Books | U | NIL | NIL | NIL. |

| 4901 10 20 | Pamphlets, booklets, brochures, leaflets and similar printed matter | U | 2.5% | 2.5% | 5% |

And also referring to sub-point (c) of point no. 4 of Notes to chapter 49 of GST Tariff. which is reproduced as below:

“Heading 4901 also covers:

(a) a collection of printed reproductions of, for example, works of art or drawings, with a relative text, put up with numbered pages in a form suitable for binding into one or more volumes;

(b) a pictorial supplement accompanying, and subsidiary to, a bound volume: and

(c) printed parts of books or booklets, in the form of assembled or separate sheets or signatures, constituting the whole or a part of a complete work and designed for binding. However, printed pictures or illustrations not bearing a text, whether in the form of signatures or separate sheets, fall in heading 4911.”

On combined reading of aforementioned extract of tariff and HSN 4901. the kitbox/book, which is in the form of separate sheets which are designed for binding (though not bound to maintain the use) could be covered. Further, such separate sheets (being integral part of kitbox/book) have printed pictures but such sheets also bear text, so it could be covered under HSN 4901 and not 4911.

- The Applicant also produced a sample of kitbox/book for reference, for determination of rate of tax of supply for which the question has been asked.

7. DISCUSSIONS AND FINDINGS –We went through the argument presented by the Applicant, sample of goods and department’s view. The arguments and assertions made by the applicant along with supporting case laws and documents in support of such claims are examined and the following are noted:

Is the said context, on examination of the said application, the view of this authority the above subject is as under :-

That, the relevant extract of chapter 49 of the GST Tariff is as under :-

| Tariff Item | Description of goods | Unit | CGST | SGST/UTGST | IGST |

| 4903 | Children’s picture, drawing or colouring books |

| 4903 00 | Children’s picture, drawing or colouring books: |

| 4903 00 10 | Picture Books | Kg. | NIL | NIL | NIL |

| 4903 00 20 | Drawing or colouring books | Kg. | NIL | NIL | NIL |

And also referring to point no 6 of Notes of chapter 49, which is reproduced as below

“For the purposes of heading 4903, the expression “children’s picture books” means books for children in which the pictures form the principal interest and the text are subsidiary.”

On combined reading of aforementioned extract of GST Tariff, the kit box/book should be covered under heading 4903 bearing NIL rate of tax, being the kit box/ book is a children’s picture books drawing or colouring book wherein the pictures form the principal interest an the text is subsidiary.

But, on-going through the relevant learning Kit, it is observed that:-

I) That it is not in the book form or bounded form. Therefore the said learning kit should not be covered under heading 4903 bearing NIL rate of tax.

It appears that the said learning kit is more appropriately classifiable in HSN 4901, the relevant extract of GST Tariff is as under :-

| Tariff Item | Description of goods | Unit | CGST | SGST/UTGST | IGST |

| 4901 | Printed books, brochures, leaflets and similar printed matter, whether or not in single sheets |

| 4901 10 | In single sheets, whether or not folded: |

| 4901 10 10 | Printed Books | U | NIL | NIL | NIL. |

| 4901 10 20 | Pamphlets, booklets, brochures, leaflets and similar printed matter | U | 2.5% | 2.5% | 5% |

And also referring to sub point (c) of point no. 4 of Notes to chapter 49 of GST Tariff, which is reproduced as below:

“Heading 4901 also covers:

(a) a collection of printed reproduction of, for example, works of art or drawings, with relative text, put up with numbered pages in a form suitable for binding into one or more volumes:

(b) pictorial supplement accompanying, and subsidiary to, a bound volume: and

(c) Printed parts of books or booklets, in the form of assembled or separate sheets or signatures, constitute the whole or a part of a complete work and designed for binding.

However, printed pictures or illustrations not bearing a text, whether in the form of signatures or separate sheets, fall in heading 4911.”

On combined reading of aforementioned extract of tariff and HSN 49001, the kit box/ book, which is in the form of separate sheets which are designed for binding (though not bound to maintain the use) could be covered. Further, such separate sheets (being integral part of kit box/book) have printed pictures but such sheets also bear text and in one shape, so it appears to be covered under HSN 49011020 (attracting CGST&SGST rate of 2.5%, 2.5% and IGST rate of 5%) and not under HSN 4903 attracting NIL CGST/SGST/IGST.

8. Ruling

8.1. The Authority hereby is of opinion that the kit called by the Applicant as “Class Monitor Home Learning Kit” manufactured (printed), marketed and sold is classified under HSN 49011020 and the GST rate is 5% (CGST 2.5% & SGST 2.5%) and as per IGST rate of 5% entry 201 of schedule I of notification number 01/2017 CGST (rate) and corresponding SGST notification as amended from time to time.

8.2 The ruling is valid subject to the provisions under section 103 (2) until and unless declared void under Section 104 (1) of the GST Act.

Prices of BUSY Increasing from 1st June, 2024. Click Here

Prices of BUSY Increasing from 1st June, 2024. Click Here